Tax Deducted at Source is an add-on for Sage 300 ERP and it is one of the ways to collect income tax. The TDS add-on provides various transactions, reports and forms. In this blog we will discuss about deduction and remittance report which is very useful during the auditing.

This report, gives the deduction and remittance details of the vendors with various options. This can be used to help users to search for the available deductions to make remittance. Also the user can clarify the remittance and deduction details as on date applying the various factors.

New Stuff: Migrate Item Price Lists from Sage 50 CAD (Simply Accounting) to Sage 300 ERP

To print this report Go to

Tax deducted at source–> D/T transaction report–>Deduction and remittance

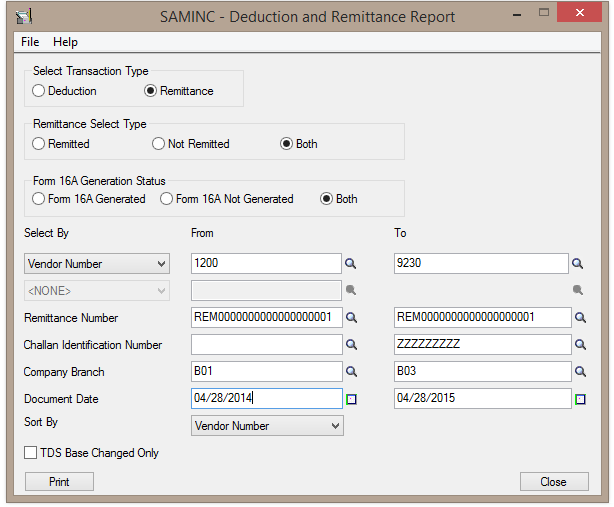

To make your selections in the following fields:-

Select Transaction Type: select the transaction type whether it is deduction or remittance.

Deduction Select Type: If the user selects the Deduction transaction for report, he must also select the deduction type. The following are the types which are available for deduction.

⦁ Remittance Created: The deduction details which are created for the remittance.

⦁ Remittance Not Created: The deduction details which are not yet created the remittance.

⦁ Both: The details combined with the above two options.

Remittance Select Type: The following are the types which are available for remittance.

⦁ Remitted: The remittance details that are really remitted to the bank (i.e. the records should have the challan number and date).

⦁ Not Remitted: The remittance details that are created but not yet remitted to the bank (i.e. the challan and date details should be blank but remittance created).

⦁ Both: The details combined with the above two options.

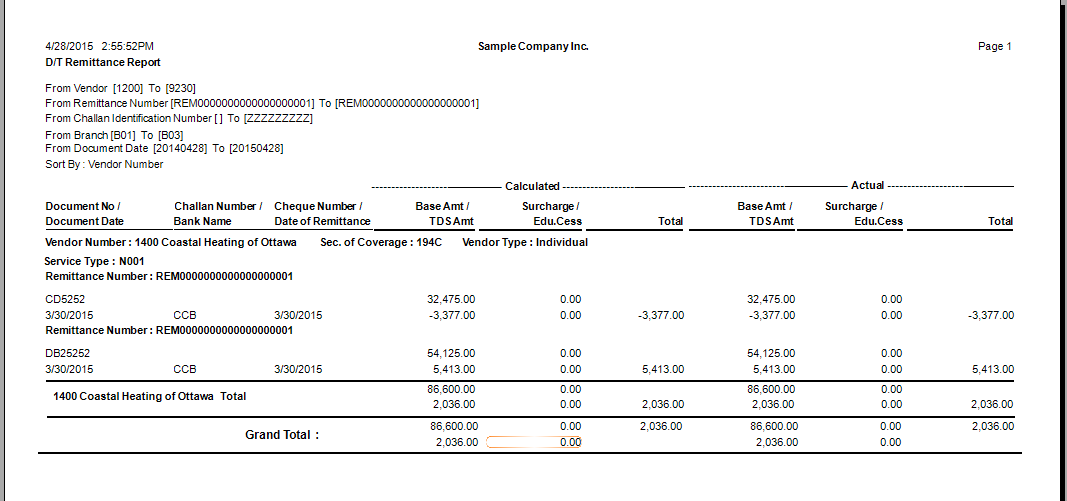

Suppose I have selected the parameter as shown in the above screen and printed the report. Please refer below screen shot.

In this way, the report gives all deduction and remittance information by vendor number, Service type and section of coverage, User can Easily find out document number, bank name, calculated and actual TDS amount, Total, grand Total.

TDS deduction and remittance report in sage 300 ERP very useful during the auditing and saves lot of time and stress of user.

Also Read:

1.Sage 300 ERP TDS and TCS Forms and their periodicity

2.TDS Section Summary Report

3.Reverse Remittance entry Option in the Greytrix TDS utility

Sage 300 ERP – Tips, Tricks and Components

Explore the world of Sage 300 with our insightful blogs, expert tips, and the latest updates. We’ll empower you to leverage Sage 300 to its fullest potential. As your one-stop partner, Greytrix delivers exceptional solutions and integrations for Sage 300. Our blogs extend our support to businesses, covering the latest insights and trends. Dive in and transform your Sage 300 experience with us!

Pingback: Deduction And Remittance Report is now on Posting date - Sage 300 ERP – Tips, Tricks and Components