The Host-to-Host Architecture – Payment Advice through Bank (One Direction)

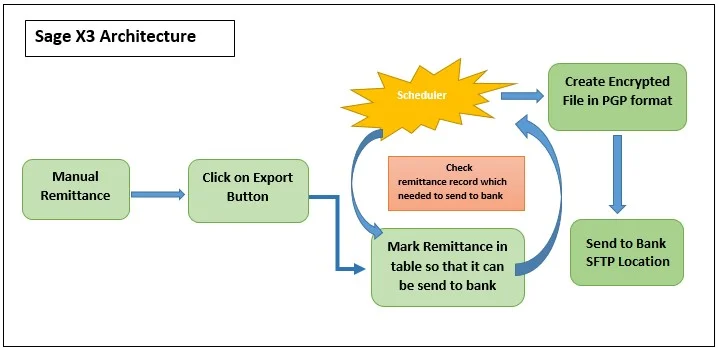

Sage X3 Bank Remittance file generation architecture & encryption

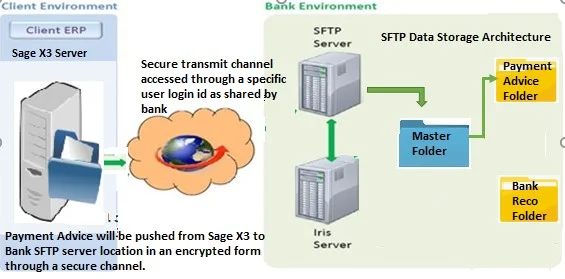

Sage X3 to Bank SFTP Transmit Architecture

Note: Encryption will include the public key of the bank which will help the bank to identify the authencity of the file.

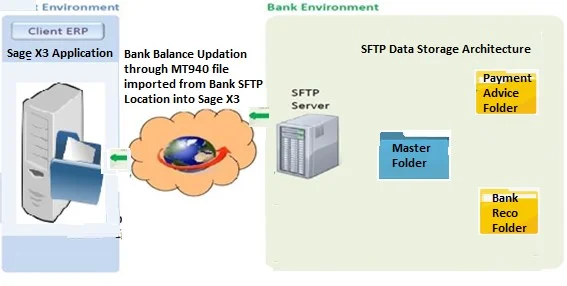

The Host-to-Host Architecture – Bank Balance Up-dation (One Direction)

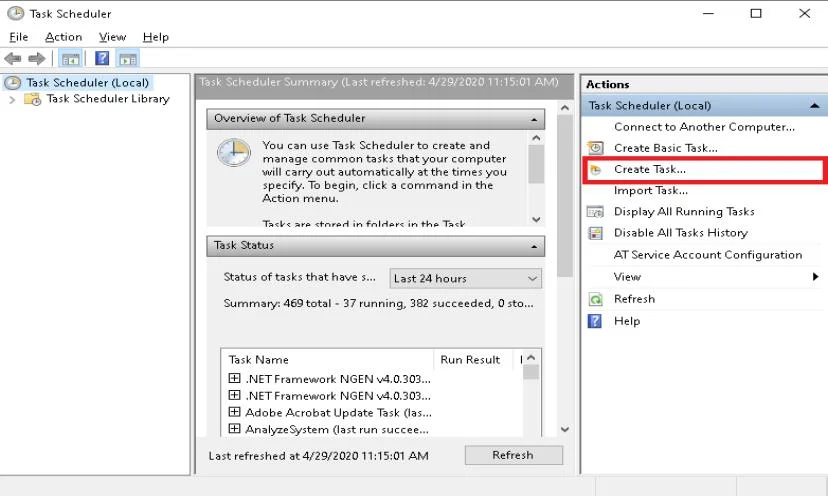

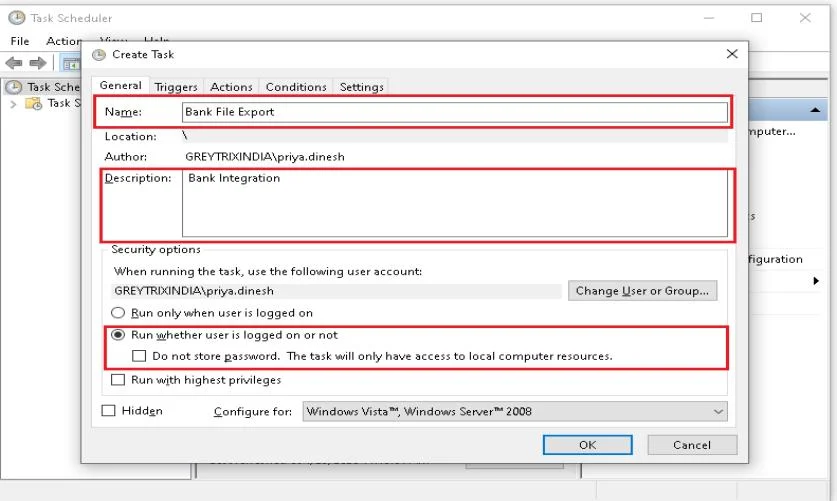

STEP 1: Create scheduler task:

STEP 2: Details of Task

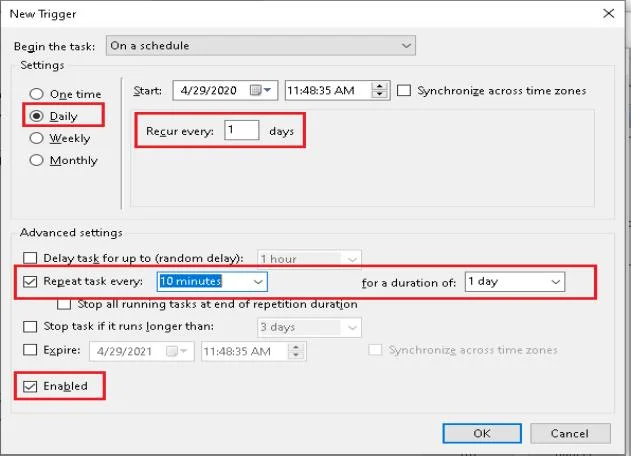

STEP 3: Specify condition to trigger the Task:

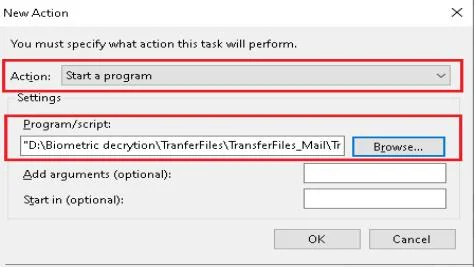

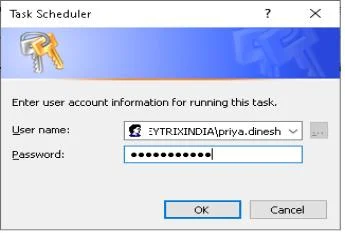

STEP 4: Specify executable file which needs to execute:

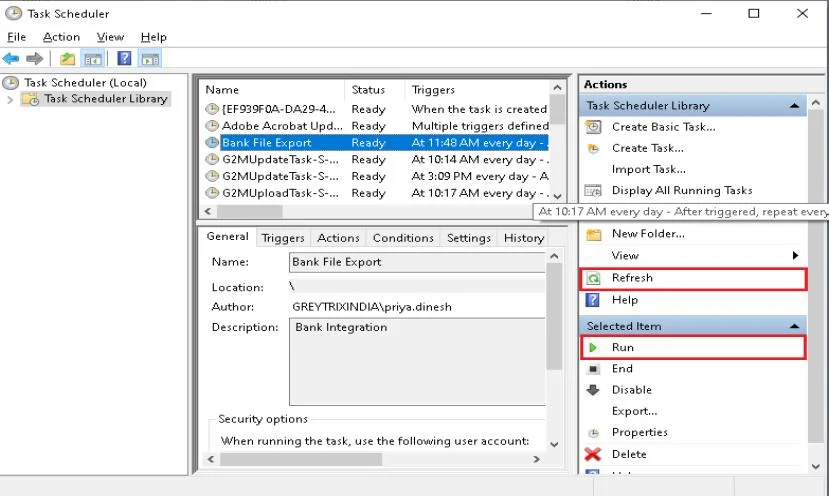

STEP 5: Click on Refresh:

STEP 6: Run the Task

© 2024. Greytrix Africa Ltd