It refers to the purchaser's Personal Identification Number (PIN). Capturing this information is necessary only when the buyer intends to claim input tax for the VAT paid. In such cases, the buyer should provide their PIN details.

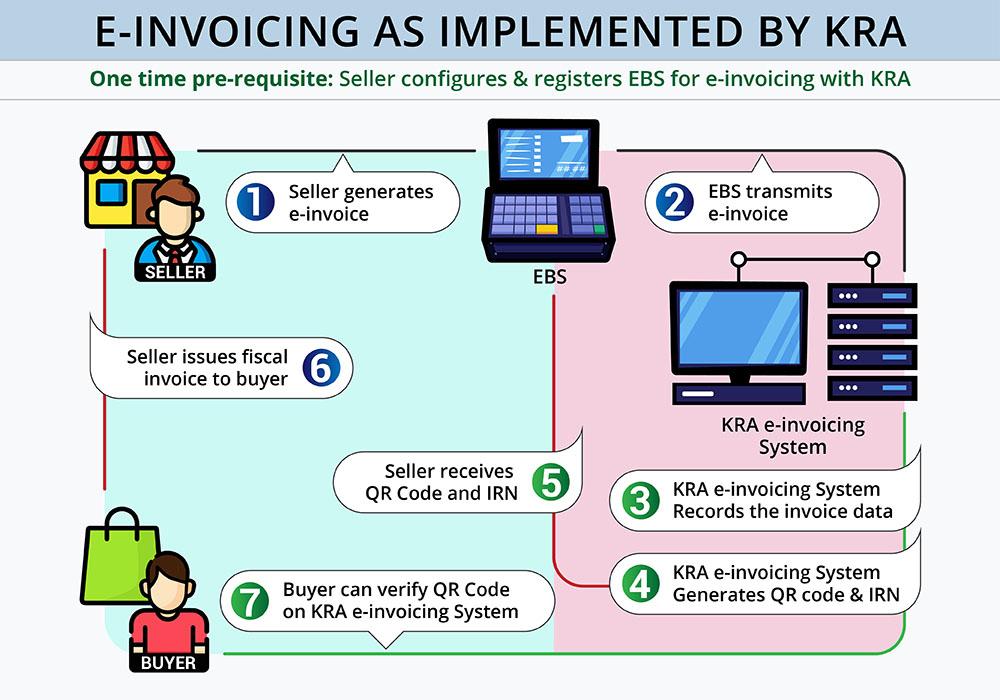

The Kenya Revenue Authority (KRA) issues this unique number to identify the Electronic Tax Register (ETR).

This unique number is generated by the ETR for each tax invoice issued.

This code is included on the tax invoice to confirm validity.

The E-invoicing system for Kenya and Mauritius enables smooth integration of the electronic billing system, promoting efficiency and ease of use.

Our advanced e-invoicing solution streamlines processes and ensures data integrity with robust duplicate e-invoice protection, safeguarding against potential redundancies or billing errors.

Customize your e-invoicing template to meet your requirements with our e-invoicing software.

Our e-invoicing solution can automatically validate your invoice data, ensuring complete accuracy in invoice generation.

© 2024. Greytrix Africa Ltd