We are introducing Greytrix Africa's Fast and Secure MRA e-Invoicing Solution! Our quick and seamless e-invoicing software effortlessly generates e-invoices. Get ready for e-invoicing in just a few days and experience the fastest invoice generation.

Our e-invoicing solution features multiple auto-validation checks to ensure complete accuracy and compliance with Mauritius Revenue Authority (MRA) requirements. Designed for Mauritius, it promotes data precision and effortless e-invoice generation in accordance with MRA standards.

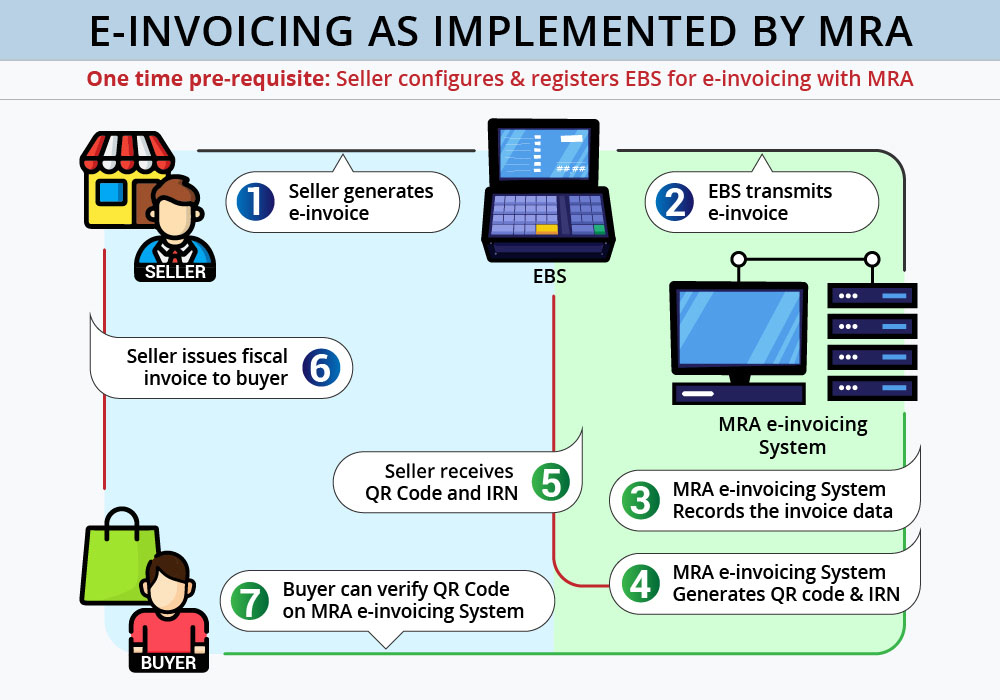

The Mauritius Revenue Authority (MRA) has implemented the e-invoicing mandate to digitalize and improve VAT compliance in Mauritius. This initiative aligns with the recent amendment to the Value Added Tax Act (VAT Act) regarding the e-invoicing system. Greytrix Africa's e-invoicing software guarantees full compliance with MRA regulations and offers seamless integration with Electronic Billing Systems (EBS) for a smooth invoicing experience.

It refers to the purchaser's Personal Identification Number (PIN). Capturing this information is necessary only when the buyer intends to claim input tax for the VAT paid. In such cases, the buyer should provide their PIN details.

The Mauritius Revenue Authority (MRA) issues this unique number to identify the Electronic Tax Register (ETR).

This unique number is generated by the ETR for each tax invoice issued.

This code is included on the tax invoice to confirm validity.

The e-invoicing system for Mauritius ensures smooth integration with electronic billing systems, enhancing efficiency and ease of use.

Our cutting-edge e-invoicing solution streamlines processes and maintains data integrity with robust duplicate invoice protection, preventing redundancies and billing errors.

Tailor your e-invoicing templates to meet your specific requirements using our versatile e-invoicing software.

Our e-invoicing solution automatically validates invoice data, guaranteeing complete accuracy in e-invoice generation.

© 2024. Greytrix Africa Ltd