In today’s growing business world, the need for localized ERP solutions is increasing day by day. Acumatica ERP has a cloud-based platform, so the organization has a very good choice going with Acumatica. To operate Acumatica smoothly in India, there is a need for a solution that meets local regulations and business requirements.

Current challenges within an ERP.

- ERP systems are not designed considering local regulations.

- Financial reporting is not in a format that should follow the regional formats.

- The ERP system further needs to be customized by its workflow to meet the business processes and rules of the current region.

- Supporting current local taxation rules and configurations based on the same.

- We need a feature that can help customers and suppliers speed up their businesses by automating taxation.

Solution: –

Considering the above challenges, Greytrix has come up with a solution: the India Localization Suite, which has three sections: Tax Deducted at Source (TDS), Goods and Services Tax (GST), and India Statutory Reports.

- Tax Deducted at Source (TDS): As we have very user-friendly TDS configuration screens within the India Localization Pack, it is very easy for users to configure the nature of deductions for any specific vendor. This further led to the automatic deduction of the TDS.

- Goods and Services Tax (GST): Using the GST plugin, one can manage multiple GST registrations for different business locations. Also, this plugin has e-invoicing integration with an authorized GST Suvidha provider along with a print e-invoice feature. This would also help in printing the sales invoice and AR invoice in PDF format.

- Indian Statutory Reports: The reports that are designed within our application are comprised of vouchers and the reports, which are specifically designed to meet Indian business requirements.

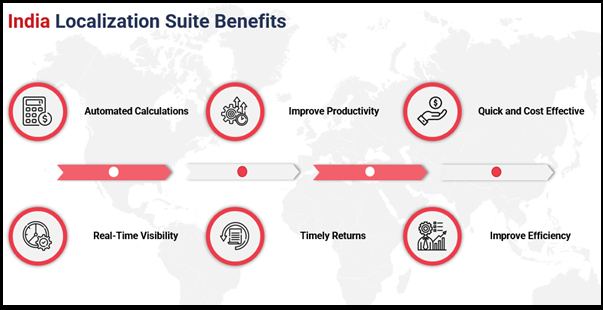

The benefits of India localization for Acumatica are as follows:

- It automates the calculation of the taxes.

- The overall productivity can be increased with the automated tax calculation process.

- This will save time and money in calculating taxes and filling out returns.

- There will be real-time visibility of the data for the businesses.

- As an automated process, we ensure timely return filing of your taxation.

- Since there are fewer manual interventions, the chances of human error are bypassed, which improves efficiency.

India Localization for Acumatica is a very useful solution developed by Greytrix to meet the specific business requirements within India. By ensuring compliance with local regulations, automating routine processes, and providing real-time data access, Greytrix helps businesses smooth their business processes, which then leads to business growth.