We have already discussed the various benefits that the TDS add-on for Acumatica offers. Now, let’s focus on the advanced features that were added to the add-on and are highly effective.

To start, there are various masters that are needed to be filled for a smooth transition of the further TDS deduction process, and those are below.

- TDS States

- Fiscal Year

- Responsible Person

- Branch

- TDS Section

- TDS Nature of Deduction

- Party Details

- Options

- Setup

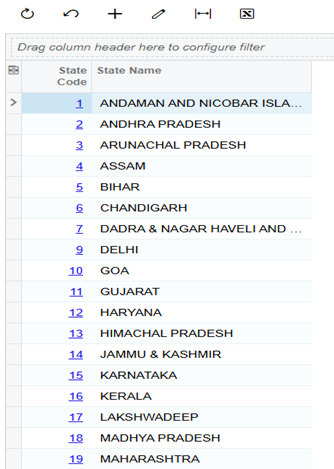

TDS States

We can import the multiple standard TDS states in one go as described by India’s Tax Regulations Authority. Leading this, there will be fewer chances of recording the wrong state code against the state.

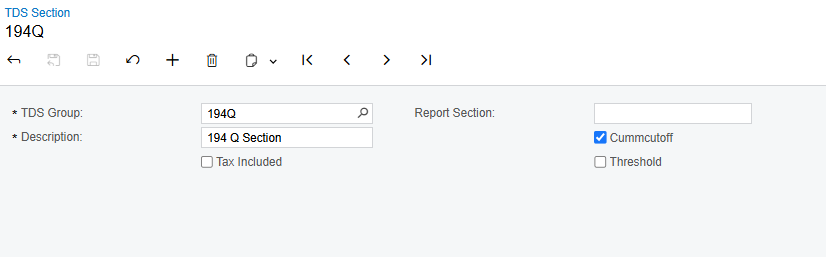

TDS section

We can now import the multiple TDS sections in one go. This is minimizing the manual efforts that would be required to create the standard TDS sections.

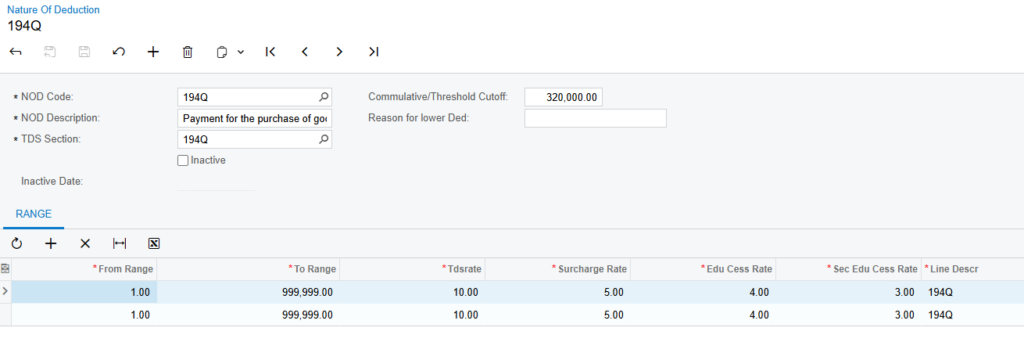

TDS Nature of Deduction

Based on the TDS sections imported or created, we can enter the multiple nature of deductions in one go with the help of import scenarios we have designed to meet the requirements. The required information can be updated or added in the source file and can be imported into Acumatica.

TDS Transactions

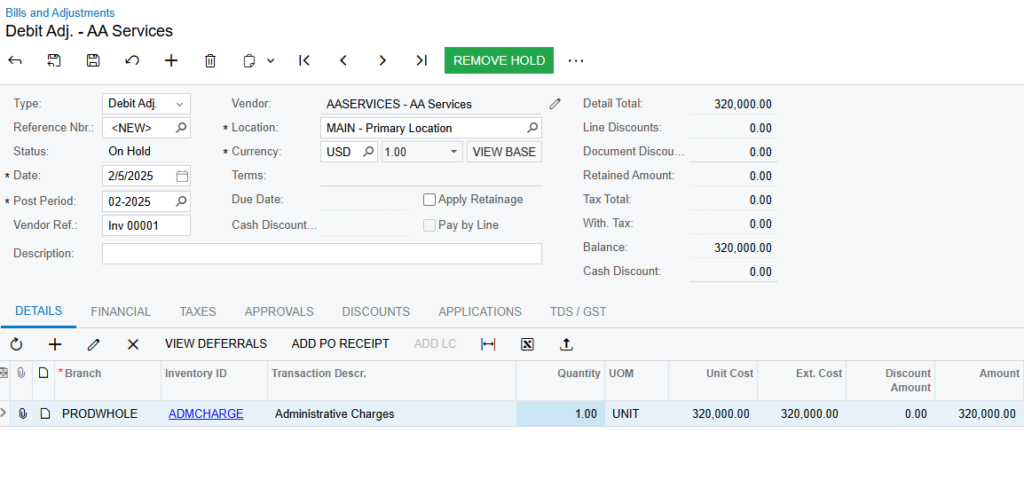

AP Bills

The bill, which has been used to deduct the TDS from the party, can be reversed with the standard Reverse Bill feature, and the corresponding TDS deduction entry will also be reversed with this, and no additional manual process needs to be done to reverse the TDS.

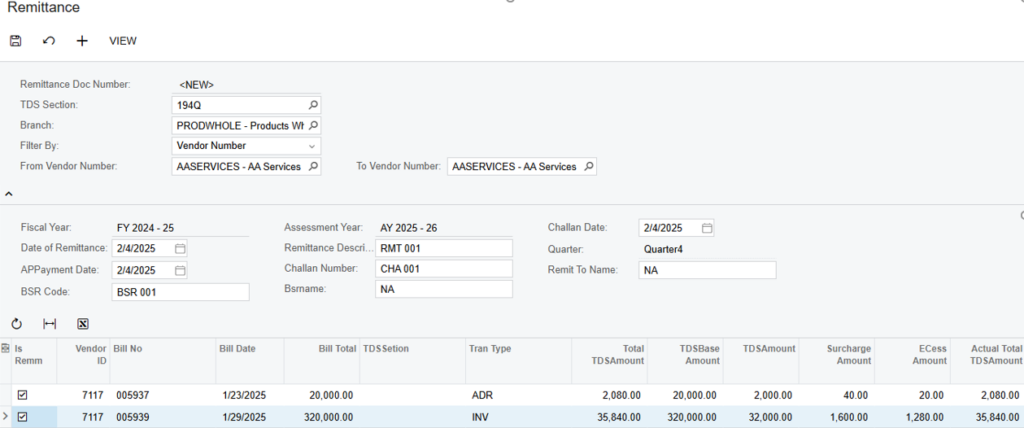

Create Remittance

The bill for which the TDS has been deducted needs to be paid to the government using a challan for different TDS sections. After the remittance, the deductor must file a TDS Return (26Q/27Q) as applicable.

Conclusion

The TDS addon for India in Acumatica would be a robust plugin that will help in following Indian taxation standards in calculating taxes and following the reporting rules as well.