TDS for India in Acumatica would involve implementing and customizing modules to comply with the India’s tax regulations. This includes auto-calculation of TDS, deductions, reporting, and filling of the TDS as per Indian tax rules.

Current Challenges

- ERP systems are not designed considering local regulations.

- Financial reporting is not in a format that should follow the regional formats.

- The ERP system further needs to be customized by its workflow to meet the business processes and rules of the current region.

- Supporting current local taxation rules and configurations based on the same.

- We need a feature that can help customers and suppliers speed up their businesses by automating taxation.

Solution

Considering all the above challenges, we have come up with a solution of a TDS addon that will minimize user interference in calculating, deducting, and filling the TDS manually.

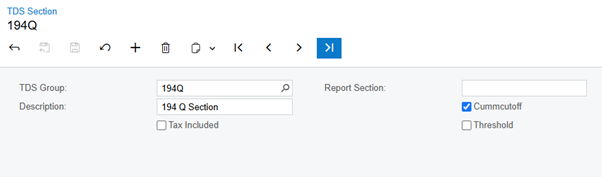

Setup of TDS Masters

The setup of the TDS masters comprises 3 major components, i.e., the TDS section, the TDS nature of deduction, and TDS suppliers.

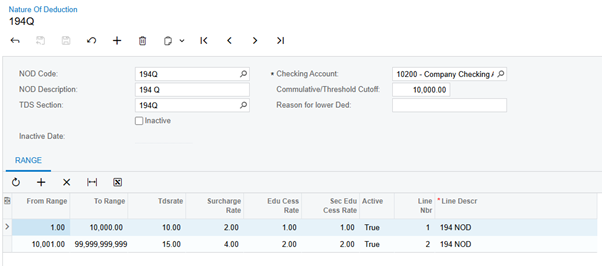

TDS Nature of Deduction

The TDS section recorded earlier will be used in the nature of deductions, and required percentages for those NODs will be attached to the NOD.

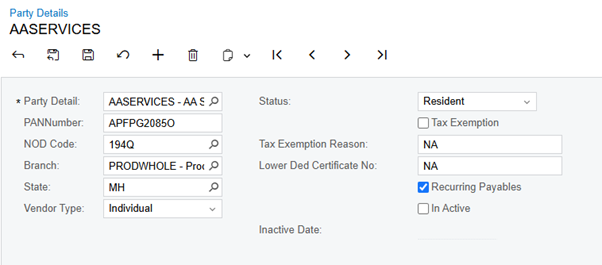

TDS Party Details

TDS party detail will store the information of the vendor who is eligible for deduction of TDS, and so it will be stored here, and NOD will apply to the vendor accordingly.

TDS Transactions

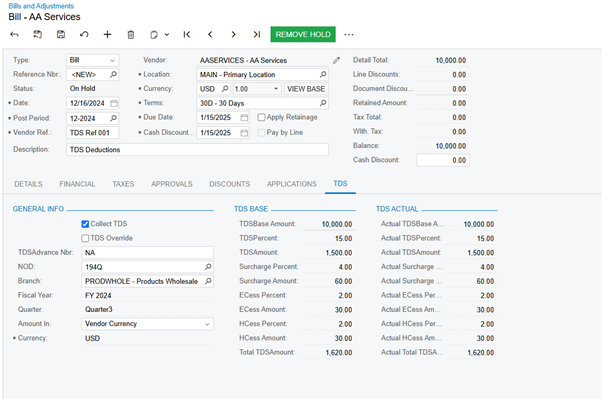

AP Bills

AP Bills plays a vital role in calculating and deducting the TDS against a bill recorded in the system, and this goes through various scenarios of the Indian Income Tax regulations, and so the calculations are always correct as expected.

The TDS deducted will be remitted in a bunch or one by one as per the choice of the user and based on that further reporting, i.e., Form 16, Form 26Q/27Q, and Form 17, can be printed/generated.

Conclusion

The TDS addon for India in Acumatica would be a robust plugin that will help in following Indian taxation standards in calculating taxes and following the reporting rules as well.