Companies operating on Project and Job Costing Basis need to file TDS, but then parameters of TDS filing vary from Company to company. Significant entities which are needed for PJC TDS deduction are Project, Contract, Jobs etc…

Whenever TDS is deducted, an Adjustment Entry is created but Adjustment creation for PJC Invoices needs Project, Contract, and Jobs entities. Secondly, to have a correct view of profitability contract wise, adjustment needs to be proportioned correctly as per contracts and phases. That’s the reason Greytrix TDS does not handles the PJC Adjustments. However, we have provided a workaround which will make it possible for the PJC companies to use Greytrix ADD-ON.

Greytrix TDS has tried to accommodate a partial feature for the PJC companies; now you may wonder what do you mean by “Partial” and thus without keeping much suspense let’s check this out.

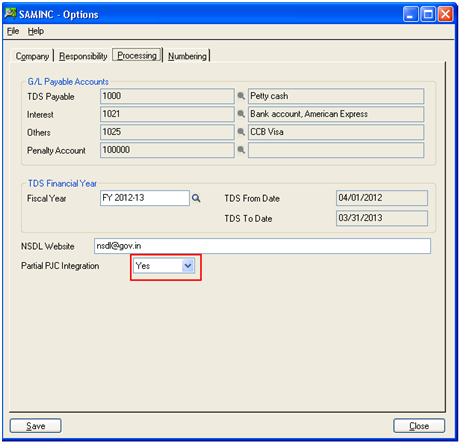

If you check Greytrix TDS Option screen you may find an option “Partial PJC Integration”, turning ON this screen will make the PJC Integration active in your Sage 300 ERP system.

Whenever we select “YES” we create only the remittance entry for the particular PJC invoice, and there will be no adjustment created. User has to create Adjustment entries manually to reflect the deduction part for the PJC documents.

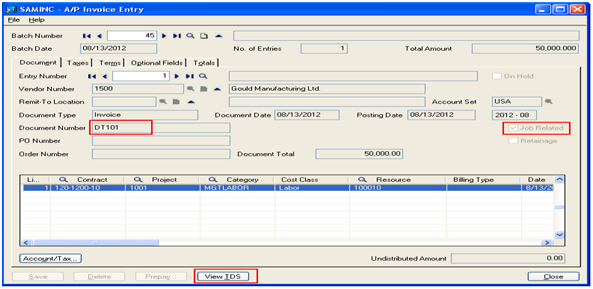

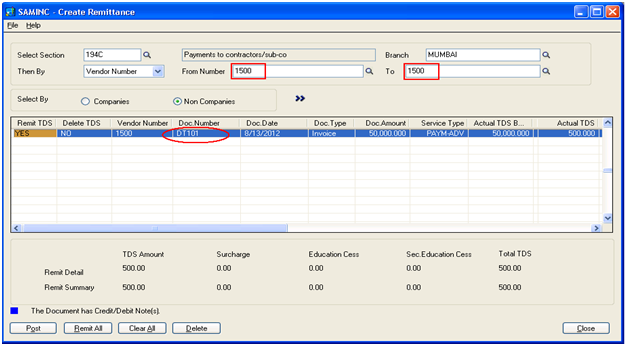

For example, consider an Invoice “DT101” for TDS vendor 1500.

After posting this invoice, it will create a deduction as you can find in Create remittance screen (refer below screen shot) and user need to create an adjustment entry manually in the AP adjustment entry.

To know more information related to PJC Integration in Greytrix TDS module for Sage 300 ERP, write us at sageaddons@greytrix.com