With effect from July 1st, 2012, Central Government of India has notified a new partial Reverse Charge Mechanism for Payment of Service Tax in respect of certain Taxable Services. Service tax is an indirect tax, where Service provider has to collect tax from Service Receiver and has to deposit it into government account.

Let’s see the rules and terms of how government has formed the structure of reverse charge for service tax.

As per Sec68 (1) of finance Act 1994, every entity or person providing taxable service to any entity or person is liable to pay service tax.

Hence, liability to pay service tax is on the Service Provider. However, an exception to above said rule has been provided under sub section (2) of Sec68 of the Act, in terms of which Central Government of India has power to notify services (List of such services is mentioned below) in respect of which, even Service Receiver shall be liable to pay service tax wholly or partially . This is termed as Reverse Charge Mechanism.

Using Sage 300 ERP (formerly Sage Accpac ERP), users can take care of this process effortlessly, but let us understand the details before we start to configure this in Sage 300 ERP.

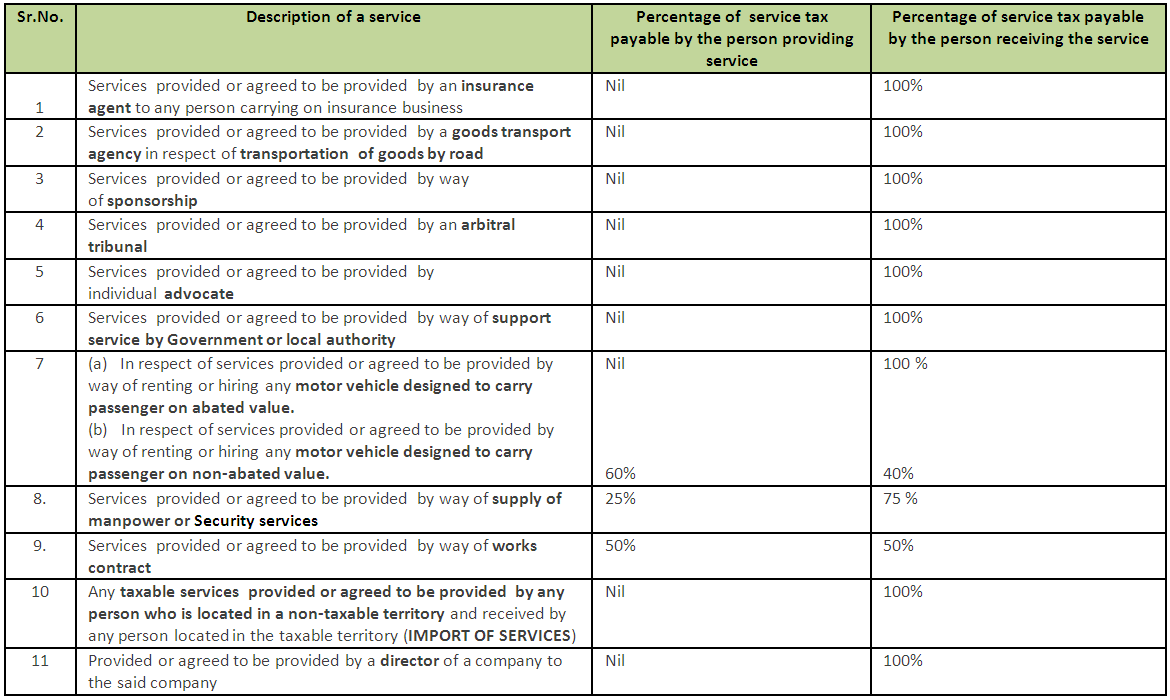

Following is the table containing the services included in the Reverse Charge Mechanism;

Note: Read FAQ about Director and Security Services Under Reverse Charge Mechanism

Thus, the above services need to be defined in your Sage 300 system, so that you can take care of all the above points and pay Service Tax accordingly.