In our last blogs we have discussed about the Party Details and DT Options that need to be setup properly before starting up for Greytrix TDS module. In this blog we will discuss on TDS sections and role of State codes in Greytrix TDS for Sage 300 ERP.

For Part I: Configuring Greytrix TDS in Sage 300 ERP – I

For Part II: Configuring Greytrix TDS in Sage 300 ERP – II

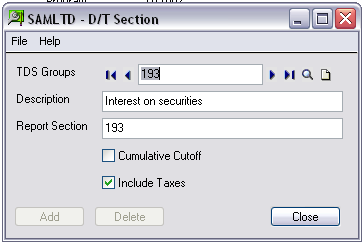

• TDS Section:

The tax calculation is depending on the section of coverage defined in the system. The section of coverage will determine the method of calculation and e-filing returns. The sections are created automatically while activating the DT module.

These sections are set and defined as per Government norms and regulations

The New Stuff: Location Grouping in GreyMatrix for Sage 300 ERP

Whenever the section is marked as a Cumulative Cut-off section, the tax calculation varies from the sections which are not marked as Cumulative Cut-off.

The section which is marked as “Include Taxes” will calculate the TDS on the Base Amount including Taxes.

The section which has this option marked (as false), will remove the taxes and consider only the base amount. For e.g. RENT i.e. 194I section do not have the inclusion of taxes.

• State Codes:

The state code are loaded into DT module automatically by the system while activation the module. The tax authority of India follows state code in numerical standard and all state code are provided by the Government.

The TDS reports and other setup required state code information.

In this way user can configure the Greytrix TDS and can proceed for the TDS transactions. Everything works as per Indian Taxation laws and acts.

Also Read:

1. GL Clearing Report in Sage 300 ERP

2. Manufacturers Item Number in Sage 300 ERP

3. Configuring Document Numbering for Sage 300 ERP

4. Greytrix Extended Report Pack for Sage 300 ERP

5. Multi-pricing feature in GreyMatrix Solution for Sage 300 ERP