Is there a chance there wasn’t enough money in your account and the overdraft protection glitches? Or could there have been an error on the check – for example dating it with the wrong month? Say you somehow dated it as March instead of February or something like that? Or they received the check but couldn’t cash it, or similar. Let’s see how these scenarios can be handled in Sage 300 ERP.

Use the Reverse Transactions form in SAGE 300 ERP to:

- Reverse a posted payment entry.

- Reverse a returned paid check from the Bank, and update Accounts Payable.

- Reverse a single transaction or a range of transactions at a single time in SAGE 300 ERP as per the requirement.

Also Read: Check Printing in Sage 300 ERP

When we do payment reversal in SAGE 300 ERP that was entered in Accounts Payable, Bank Services automatically updates the vendor account in Accounts Payable.

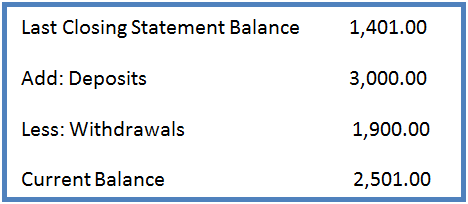

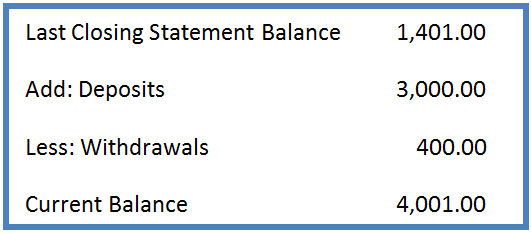

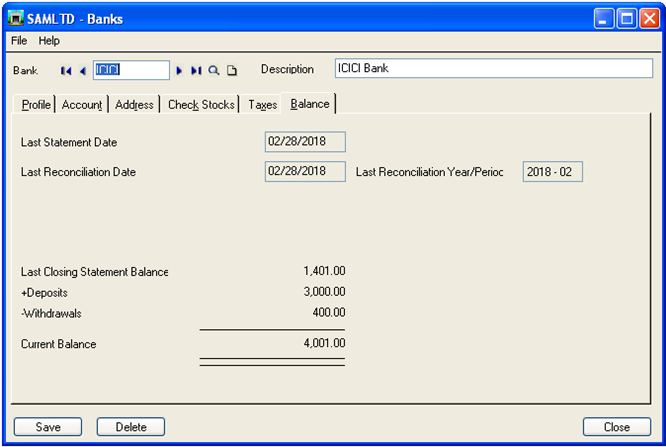

Firstly let’s analyze the Bank Current Balance.

In SAGE 300 ERP we can review the Bank Book Balance. E.g. Balance for ICICI Bank can be viewed from the above form which is in Bank Master.

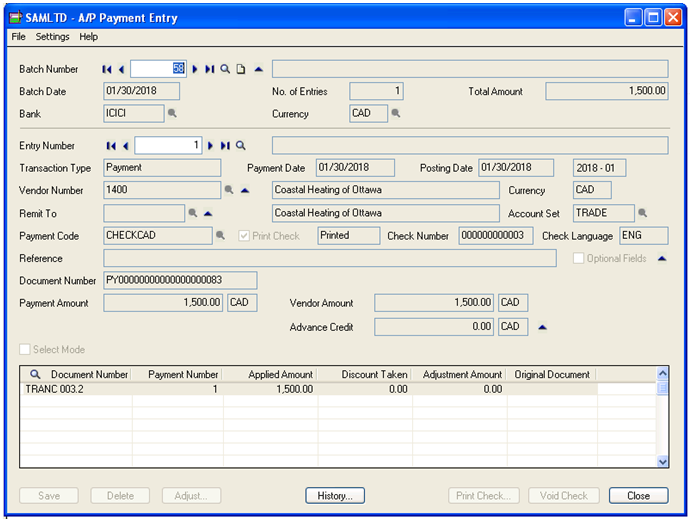

After that, we have posted an A/P Payment entry of 1,500 CAD (Canadian Dollars) and the Payment Type is “Check”.

Let’s again check the Bank Current Balance.

- Withdrawal has increased by 1,500 CAD and now it is 1,900 CAD.

- Current Balance is decreased by 1,500 CAD and now it is 2,501 CAD.

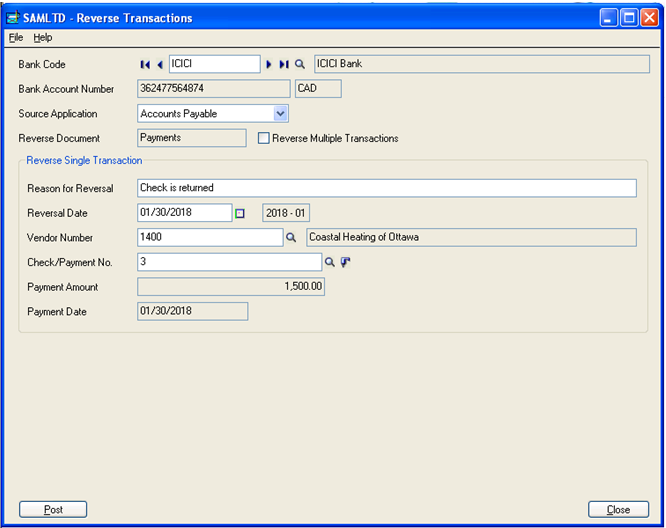

Reverse Transactions (Payment Reverse)

See below the example of Reverse Transaction for A/P Payment (Accounts Payable) against a vendor.

We can post the entry after selecting the appropriate values for Bank Code, Source Application, Reversal Date, Vendor and Check/Payment No. Next, to that, it will create a GL transaction in un-posted status under General Ledger module. Then go to General Ledger module and post the GL transaction of the Reverse Transaction.

Just with a few clicks, the Payment Reversal entry will be generated in SAGE 300 ERP, here no need to pass the manual entry for making Reverse Payment/ Receipt.

Now we can verify the Bank Book Balance, Bank GL Balance and Vendor Balance one by one.

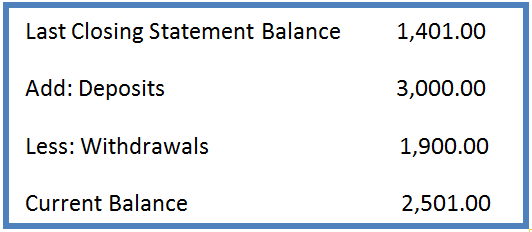

Effect of Payment Reversal on Bank Book Balance in SAGE 300 ERP

Bank Balance Status before A/P Payment Reverse Transaction

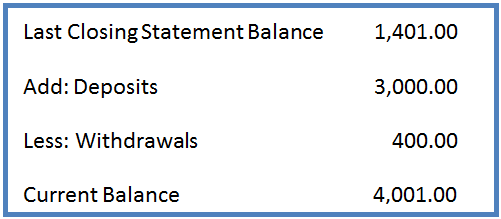

Bank Balance Status after A/P Payment Reverse Transaction

Withdrawal is decreased by 1,500 CAD and Current Balance is increased by 1,500 CAD.

SAGE 300 ERP takes care of both your bank as well as your accounting. It reduces the manual efforts of an end user thus making a payment reversal process automated through the SAGE 300 ERP.

About us

Greytrix a globally recognized Premier Sage Gold Development Partner is a one stop solution provider for Sage ERP and Sage CRM needs. Being recognized and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation expertise.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com and Magento eCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration service for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and in Sage 300c development services we offer services such as upgrades of older codes and screens to new web screens, newer integrations using sdata and web services to Sage business partners, end users and Sage PSG worldwide. Greytrix offers over 20+ Sage 300 productivity enhancing utilities that we can help you with such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East.

For more details on Sage 300 and 300c Services, please contact us at accpac@greytrix.com. We will be glad to assist you.