In this blog we will discuss about the option in Terms Code of “Due Date Table” which allows users to set fixed Due Date on Invoices.

The New Stuff: Migrate Sales Payment from Sage 50 US to Sage 300 ERP

There are scenarios where users need to set the due date on the Invoices based on the specific date range during which the invoice is generated in Sage 300.

Let’s take an example:-

1. If the invoice is created within the 1st to 10th day of the month, then Due date should be the 15th of the month

2. If invoice is generated within the 11th to 20th day of the month, then Due date should be the 25th of the month.

The above scenarios can be achieved using the existing Term code setup, by using the Due Date Type as Due Date Table.

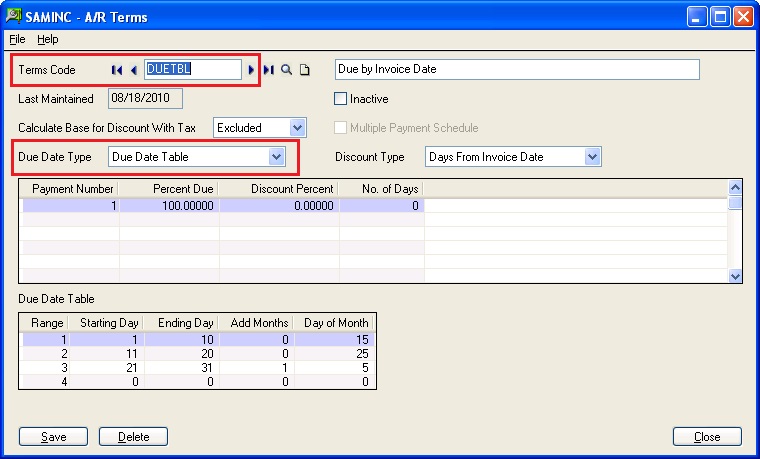

1. Create Term code with “Due Date Type” set as “Due Date Table” as show in the below screen shot.

2. You can use the Due date table to specify the date range and the fixed due date for the invoice date:

a. Range: – You can specify the number of tiers for the month according to the starting and Ending Days.

b. Starting and “Ending” day range for the invoice date.

c. Day of Month: – Fixed Day of the month on which you need to set as the due date of the invoice.

d. Add Months: – With this option the user can add the desired number of month to the determine Due Date of the Invoice of the specific month. For e.g. If he adds ‘1’ in the add months section, then while calculating the due date, it will be calculated as Date+1 months. Hence, if the invoice date is 25/03/2014 then due date will be 5/4/2014

Also Read :

1. AR Customer Receipt Enquiry

2. Advance Receipt from a Customer

3. Knowing Customer Credit Status

4. Interest Invoices for Overdue Receivables

5. Knowing Customer Credit Status