How much items have we sold in the month of December? How much in February? Have we got any sales/items returned? What are the actual cost and the margin factor after selling all these items? Can we check it monthly and half yearly? What is the last date of sale for an item? I am sure all these questions do come to your mind when you are about to check the items sales report related to accounts receivables. It is very important to your accounts receivables too.

What if you get the answers at one place?

By using SAGE 300 A/R module, you will get to know your item sales history related to Account Receivables.

The New Stuff :Sage 300 ERP Order Entry – All in One

Let’s see how to get it:

Suppose you don’t have any program for maintaining your inventory. You sell items on a continuous basis without entering the stock. You want to create an item and sell it. I know you don’t want to wait but need a fast process to apply. Here comes the SAGE 300. There is a provision in SAGE 300 Accounts receivable module where you can create an item and sell it to your customer.

It delivers – Item Sales History Report

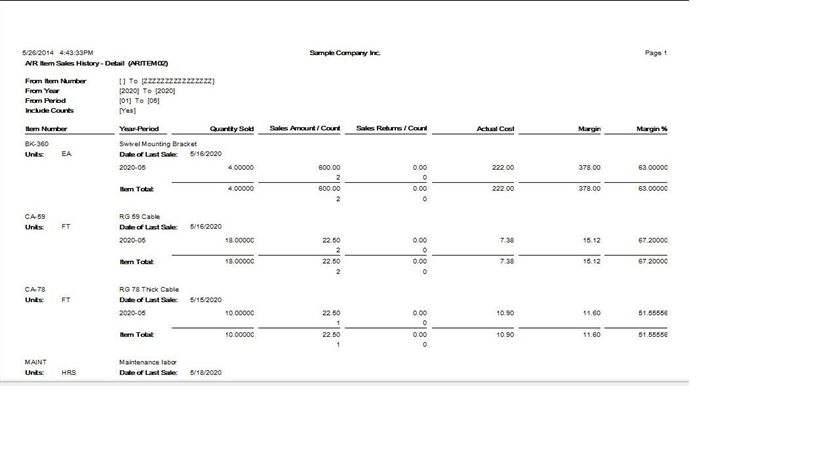

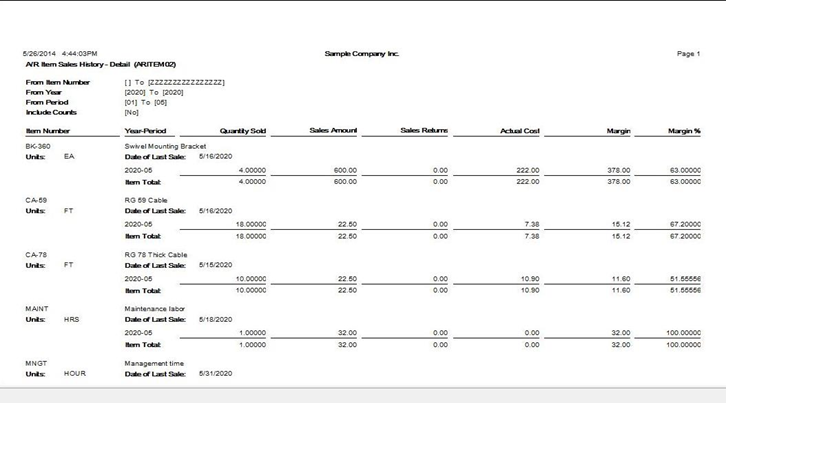

In SAGE 300, we can easily get the report list of sales activity for the items in your Accounts Receivable system. A user prints this report when there is a need to check on sales activity such as the most recent date that an item was sold, the quantity sold during a particular period, the number of sales returns or the profit margin for an item or items.

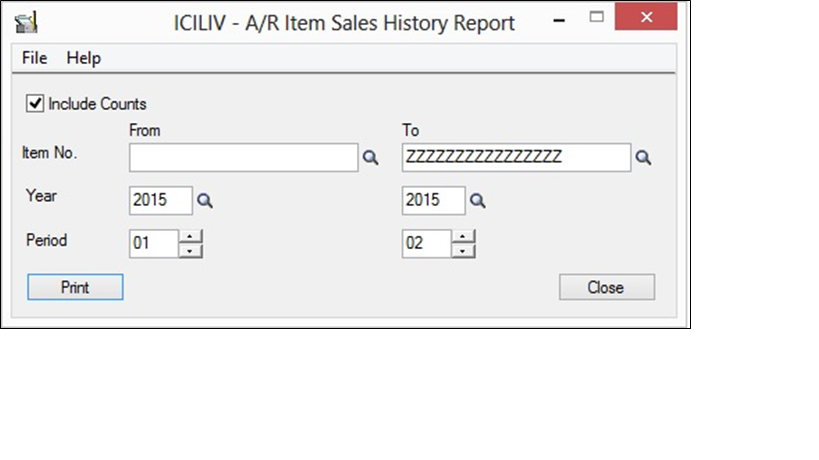

A/R – A/R transaction reports – Item sales history.

Here in the form, you put the values “from item no. to item no.” and select the period. Click print to get the report. Wait a minute, before you click the print button; see the check box “include counts”. If you select “include items”, it will display the total sales count values of items. E.g. how many times the particular item was sold in that period?

Here you go, Item sales history for a particular period included total counts.

Here you go, Item sales history for a particular period included total counts.

Let’s take an example; Say we are into consulting of providing labour to customers. We recently provided 3 labours to a customer xyz. We set the cost as 100 USD for a labour and for customer it is 200USD. By doing this we will get actual costs, selling price and margin.

Let’s take an example; Say we are into consulting of providing labour to customers. We recently provided 3 labours to a customer xyz. We set the cost as 100 USD for a labour and for customer it is 200USD. By doing this we will get actual costs, selling price and margin.

What exactly information do you get on this report:

- The Sales Amount column lists the item price, multiplied by the quantity sold.

- The Sales Returns column lists the item price, multiplied by the quantity returned.

- The Actual Cost column lists the item cost, multiplied by the quantity sold.

- The Margin column lists the difference between the sales amount and the actual cost (usually the profit).

- The Margin Per cent is calculated by dividing the margin amount by the sales amount.

So if you are planning to create items and sell it without maintaining a stock inventory and need a regular report for you’re A/R item sales, go for SAGE 300 A/R module.

Also Read:

1. Features in Accounts Receivable Module of Sage 300 ERP 2012

2. AR Revaluation Process in Sage 300 ERP

3. Payment Follow-up in Sage 300 ERP

4. National Accounts Management in Sage 300 ERP

5. Account Receivable Transaction Reports in Sage 300 ERP