In our last blog, we had discussed about Statutory and Excise Module-Configuration-I. Going further, in this blog we will discuss how to configure the taxes so that excise duty and other related taxed will get calculated automatically.

We must have to do the tax configuration in the sage 300 ERP which will allow us to do the calculation, accounting, and reporting of the excise duty accordingly.

To do the configuration, we must have to create the tax authority, tax groups as per the requirement and need to define the tax rate as per the government rules.

New Stuff: Ship Commit All in OE Shipment

1. Create Tax Authorities

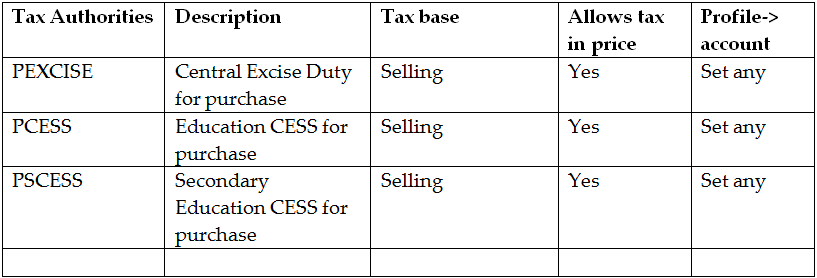

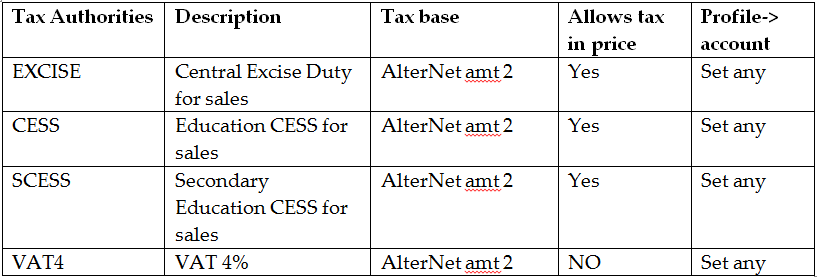

Go to Common services >>Tax services >>click on Tax Authorities >>click on new button and follows this.

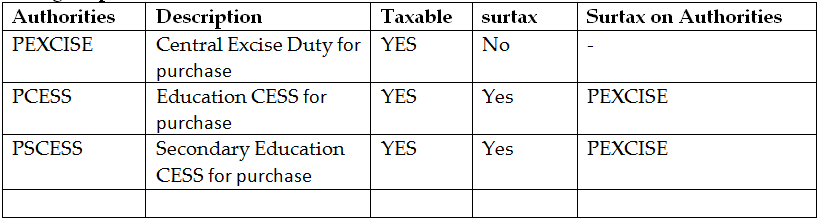

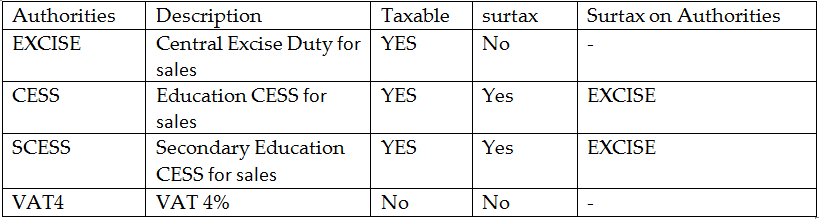

2. Set the tax classes and tax rate for the above tax authorities.

3. Create Tax Group setting as follows

Tax group for Purchase

Tax group for Sales

In this way we can configure the taxes for calculating the excise.

Also Read

1. Statutory and Excise Module-Configuration-I

2. Statutory & Excise Module-Configuration-2

3. Why use Greytrix Trading Excise

4. Transfer of Excise duties along with Inventory Transfer in Sage 300 ERP