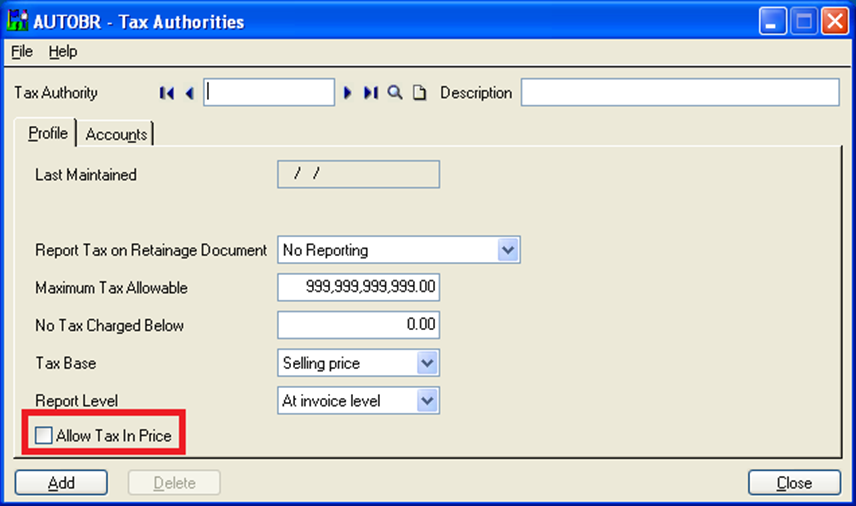

In Tax Authority Settings of Sage 300 ERP, there is a check box ‘Allow Tax In Price’ which plays a significant role while calculating the taxes in transaction screens. This checkbox gives the user two options namely,

1. If check box is un-checked, then tax will be calculated on selling price.

2. If check box is checked, then taxes charged by an authority can be included in the selling price [Tax Included option should be selected in transaction screen]

New Stuff: IC Option – Allow Negative Inventory Levels

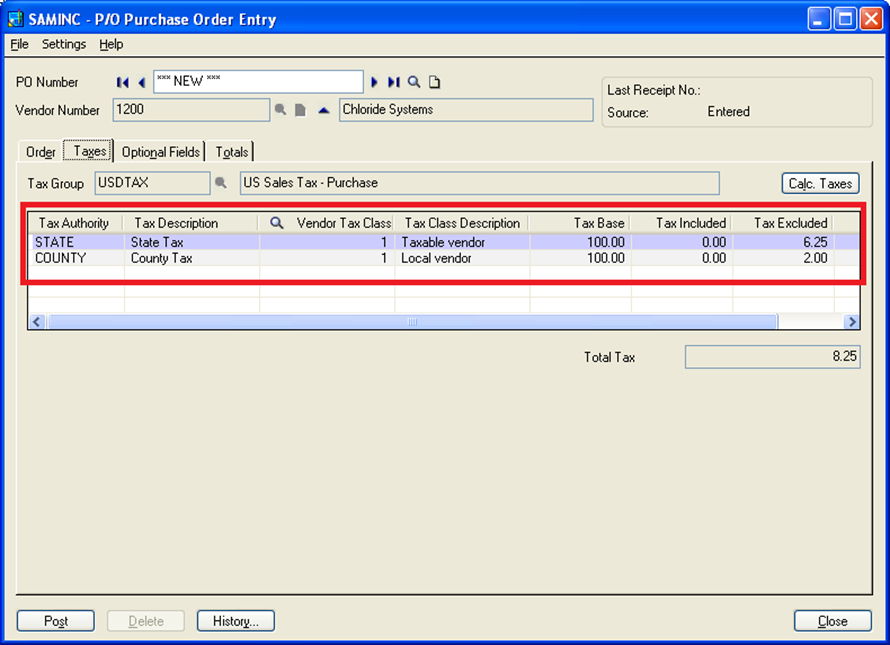

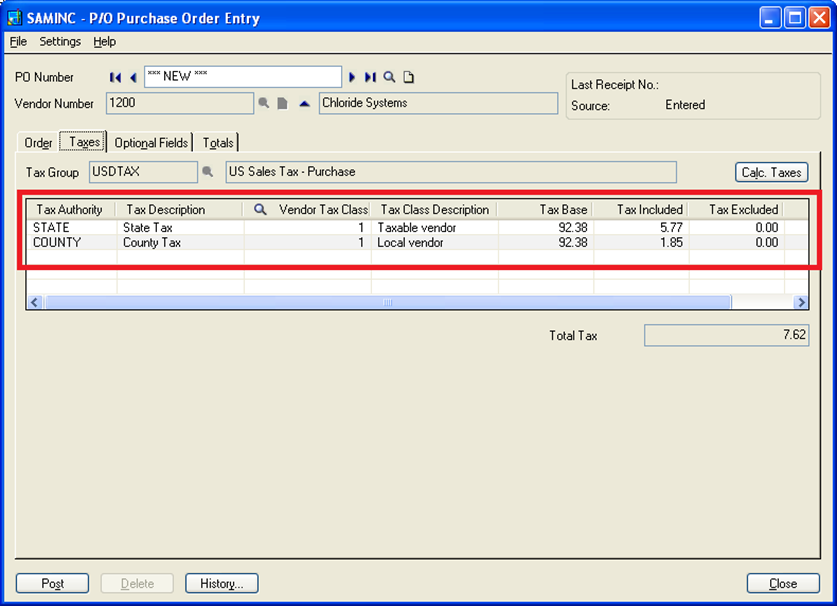

This will get clearer by the following example. Consider the scenario, for PO order entry of an item having quantity 1 and unit cost 100.

If user has unchecked the check box for the tax authorities, then while doing PO Order entry, as shown in below screenshot, tax will get calculated on unit cost. The tax base is 100 and tax amounts are 6.25 and 2.00.

If user has checked the check box for the tax authorities, then while doing PO Order entry, as shown in below screenshot, total amount will be 100; that is tax base is 92.38 and tax amounts are 5.77 and 1.85 which shows that tax amount gets included in the price.

Also Read:

1. Purchase Order in Sage 300 ERP 2014

2. Tax Calculation on the basis of Quantity in Sage 300 ERP

3. Multicurrency GL Transaction Analysis in Sage 300 ERP

4. Sage 300 ERP-Simplicity and hustle free ERP Solution

5. Project/Contract Maintenance in Sage 300 ERP