In our previous blog we discussed about “Allow Edit in Statistics in Sage 300 ERP”. Extending the discussion further we will now see how to Include Tax in Statistics for Items under AR Options.

New Stuff: Knowing Pending Transaction In AR Customer Inquiry

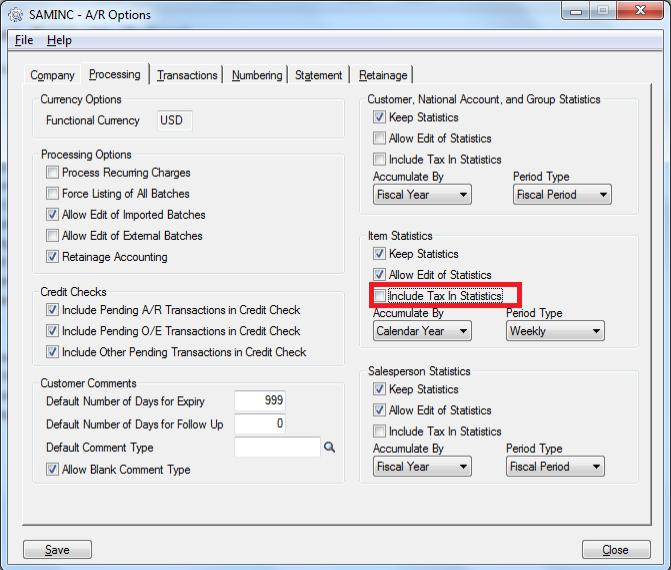

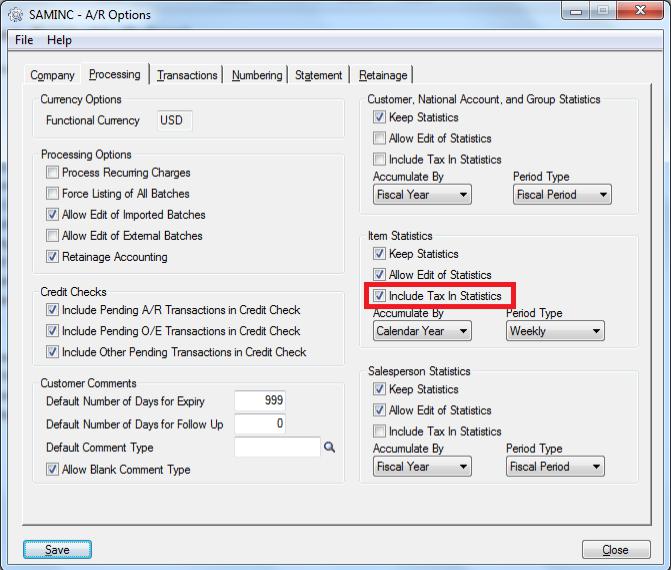

In order to access this feature you need to navigate to Account Receivable –> A/R Setup –> Options –> Processing Tab. Kindly refer the screenshot for the same.

1. If User Uncheck the option “Include Tax in Statistics” in AR Options screen under processing Tab, then Tax statistics for the transactions that are posted will not be included in the totals in the Item Sales History under A/R Transaction Reports as well as Items under A/R Setup.

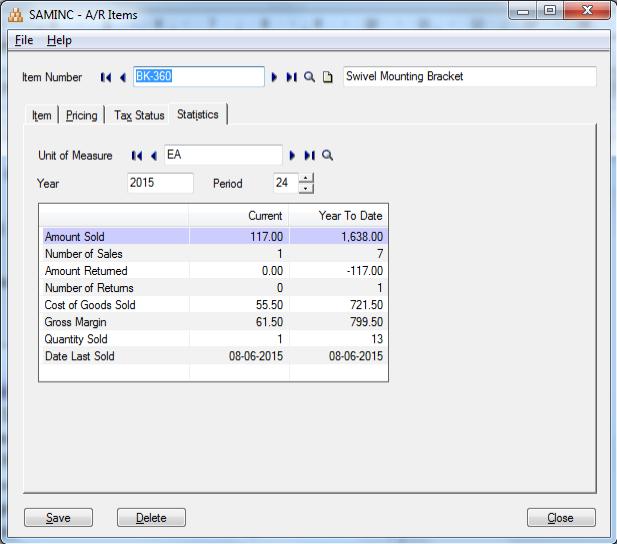

Before Transaction:

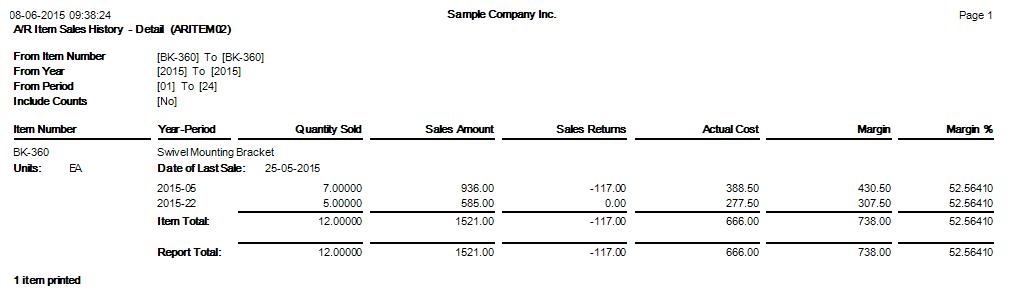

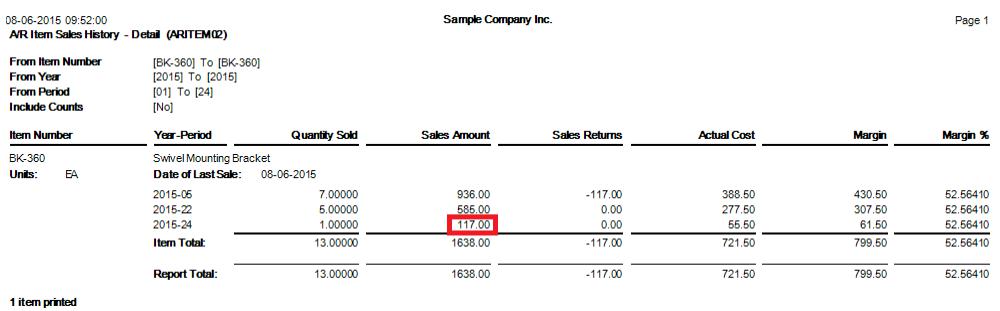

Item Sales History

Above screen shows the Item Sales History Report for Item “BK-360” before posting a transaction say Invoice with “Include Tax in Statistics” unchecked in AR options.

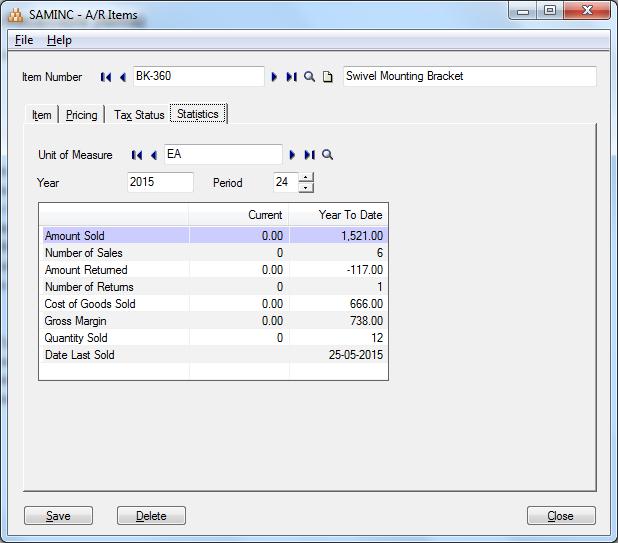

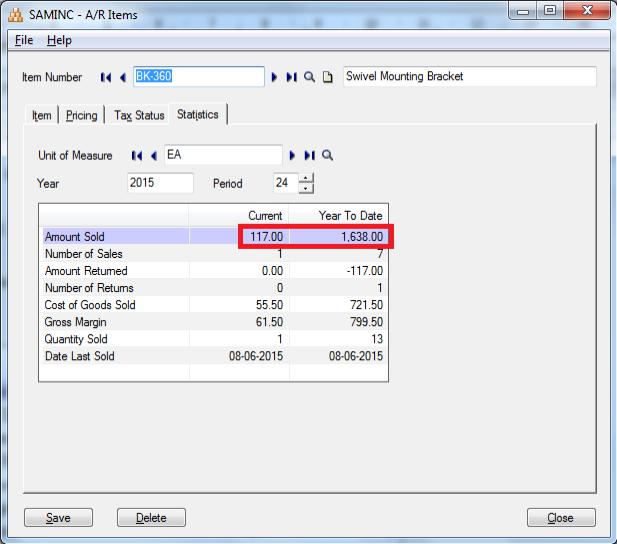

Above screen shows the statistics of Item “BK-360” before posting a transaction say Invoice with “Include Tax in Statistics” unchecked in AR options.

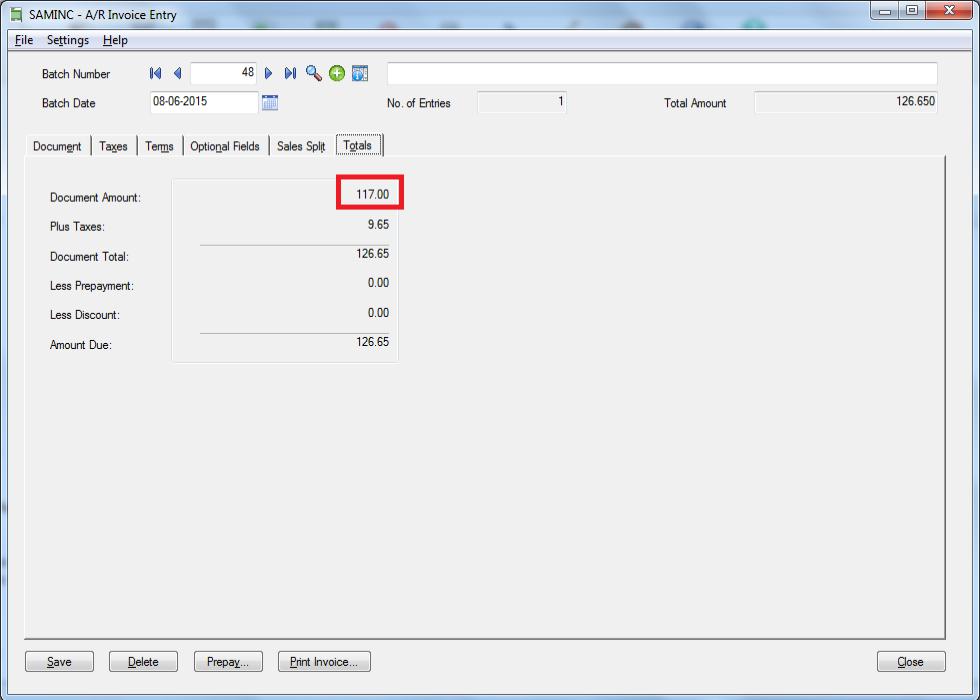

Invoice transaction

Above screen shows an Invoice is posted for Item No. “BK-360” for

Document Amount: 117 and Taxes : 9.65 which makes Amount Due 126.65

After Transaction:

Item Sales History

Above screen shows the Item Sales History Report for Item “BK-360” after posting a transaction say Invoice for Document Amount of 117 as “Include Tax in Statistics” is unchecked in AR options.

Items

Above screen shows the statistics of Item “BK-360” after posting a transaction say Invoice for Document amount of 117 as “Include Tax in Statistics” is unchecked in AR options.

On comparing before Transaction with After Transaction Item Sales History report for Item No. “BK-360” the Amount sold displayed is 117 that is Document Amount of the Invoice is included in the Item Sales History report as well as the statistics displayed in the Items Screen. This is observed as the “Include Tax in Statistics” option is unchecked under AR options.

2. If User checks the option “Include Tax in Statistics” in AR Options screen under processing Tab, then Tax statistics for the transactions that are posted will be included in the totals in the Item Sales History under A/R Transaction Reports as well as Items under A/R Setup.

Before Transaction:

Item Sales History

Items

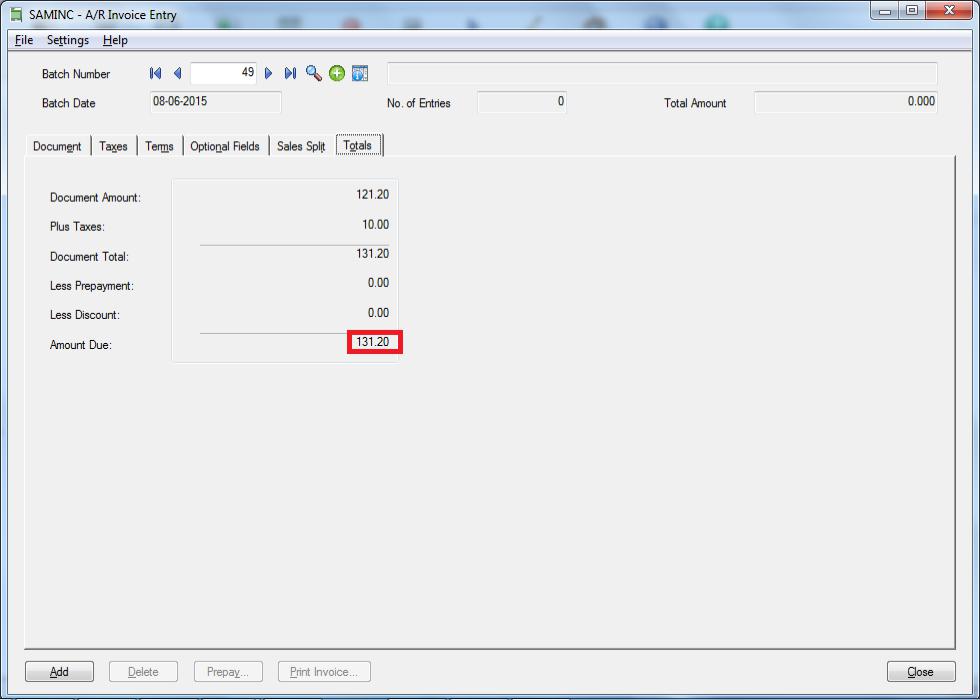

Invoice transaction

Above screen shows an Invoice is posted for Item No. “BK-360” for

Document Amount: 121.20 and Taxes 10.00 which makes Amount Due 131.20.

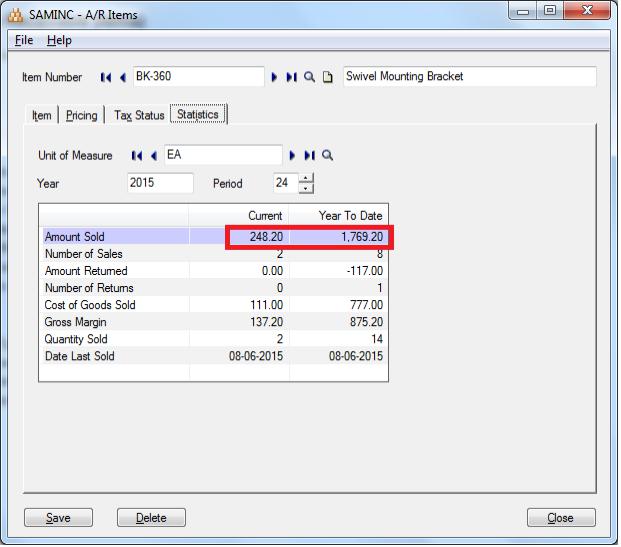

After Transaction:

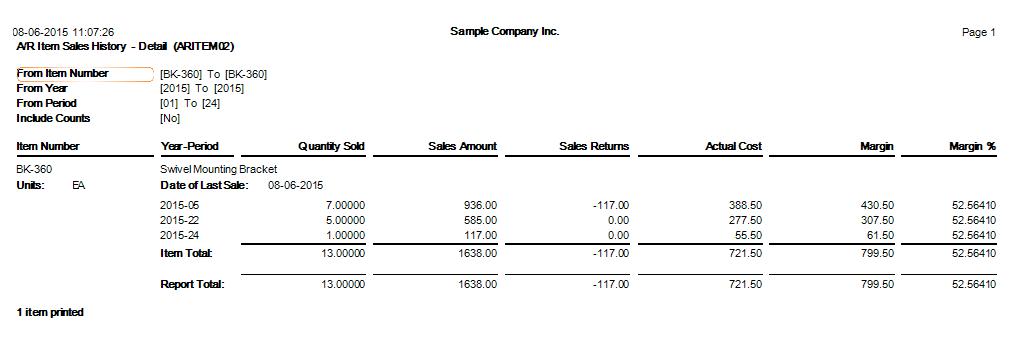

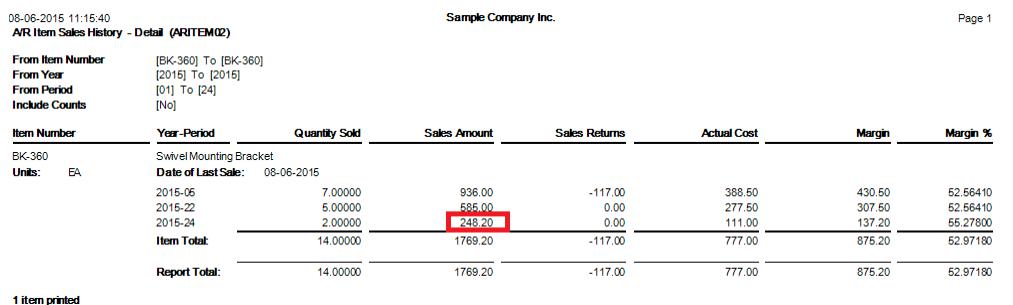

Item Sales History

Items

On comparing Before Transaction with After Transaction Item Sales History report for Item No. “BK-360” the Amount Due of 131.20 which is Sum of Document total and Taxes; is added to amount sales number of 117 as we have kept “Include Tax in Statistics” option is checked under AR options.

This is how one can keep a track of the Include Tax in Statistics for a record.

Also Read:

1. Manage AR Item Statistics in Sage 300 ERP

2. AR Options – Allow Edit of Statistics in Sage 300 ERP

3. How to Use Different Item Description for Specific Items in Sage 300 ERP

4. Populate Items on Order Entry Screen using Template Code

5. Generate BOM and Kitting items on the fly from Order Entry screen in Sage 300 ERP