Tax deducted at Source (TDS) is one of the ways to levy income tax under the various tax sections. As the name suggests, TDS is deducted from a person’s income at the source itself. The Greytrix TDS module for Sage 300 automatically calculates TDS amount on the document and deducts the TDS while the posting is done. But if due to some reason, the user wants to calculate the different TDS amount on the particular document rather than automated calculated TDS amount, in such cases user should have provision to do so.

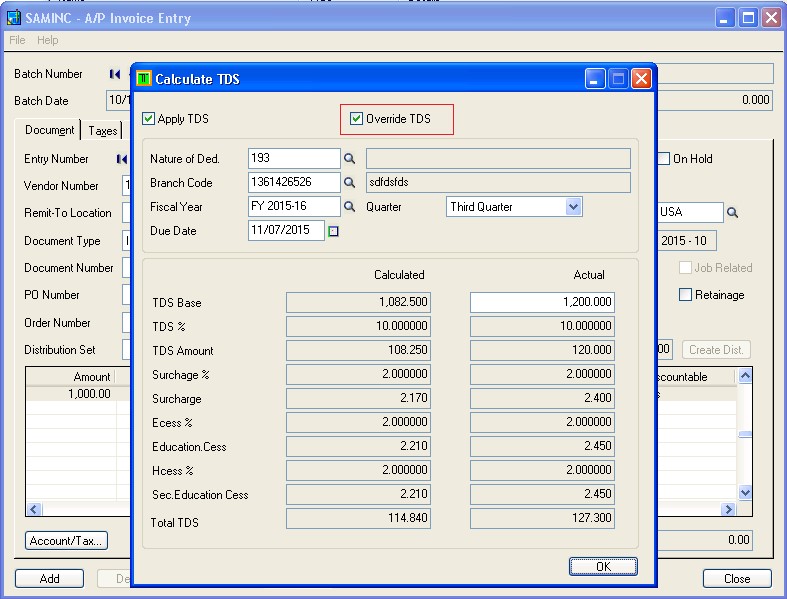

TDS module provides user to Override/change the TDS base amount so that he/she can calculate the TDS amount as per his/her requirement. We have provided Override TDS check box to do so. Once user checks the Override TDS, the TDS base amount control gets editable so that user can enter the value manually and can calculate the TDS amount refer the screen shot.

New Stuff: Migrate Vendor Custom Fields from QuickBooks to Sage 300 ERP

So as per the above screen, the program will calculate TDS amount on 1200 rather than calculating on 1082.5.

Using this feature, a user can easily adjust the TDS amount for a particular vendor on the TDS payable documents, rather than creating the manual adjustment entries.

Also Read,

1. Maintain TDS accounts Location or Branch wise.

2. Manual TDS Posting in Greytrix TDS Module for Sage 300 ERP

3. TDS Screen popup blank for TDS Vendor

4. Financial Budgeting in Sage 300 ERP

5. Configure Reverse Charge Mechanism for Service Tax in Sage 300 ERP