In this post, we will discuss about a feature of Sage 300 ERP ‘Default Detail Tax Class to 1’ in Accounts Payable.

This feature sets all the tax class to 1 while creating the A/P invoices in spite of what is defined in vendor master. If the user wants the tax class always be set to 1 then selecting this option will be useful as he need not have to always manually change the tax class.

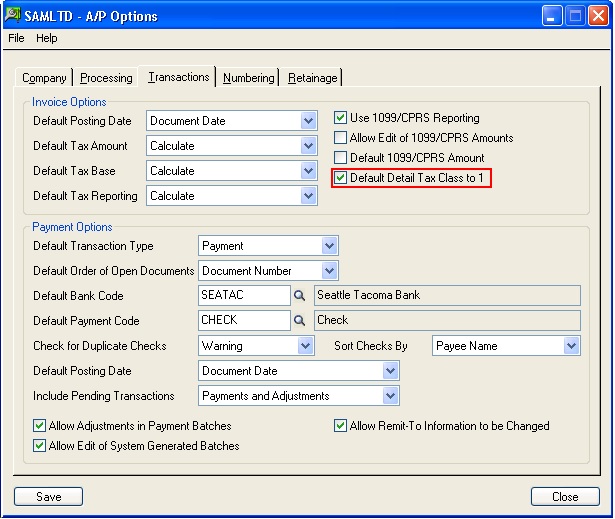

This option is found in A/P Option under the Transaction tab [Refer below screenshot].

To achieve this, navigate to Accounts Payable–>A/P Setup–>Options

New Stuff: I/C Transaction Listing Report

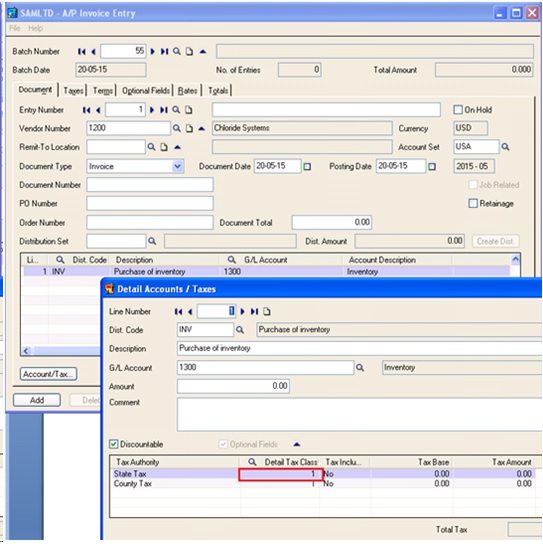

If this option is checked, the user will be allowed to use 1 as the default tax class for details on new AP invoices [Refer below screen shot].

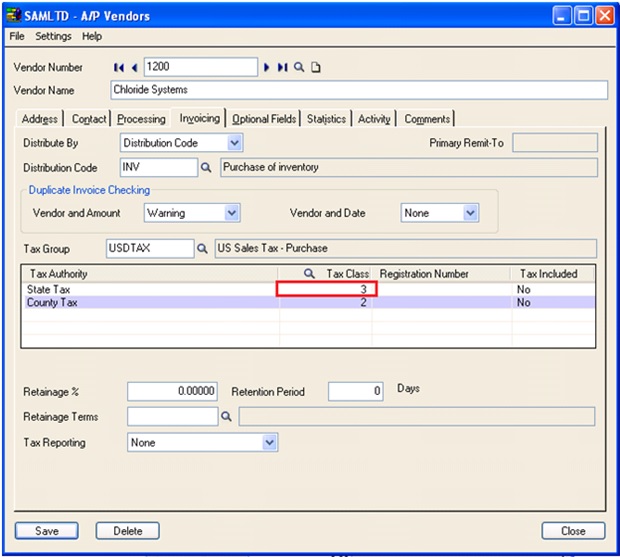

But when we take a look at the vendor master screen, we find that it has tax class as 3 and 2 defined for the same vendor [Refer below screen shot].

As the option “Default Detail Tax Class to 1” is checked in the AP Option, whenever we create Invoices the tax class will be by default set to 1 in spite of swhat is defined in AP Vendor Master.

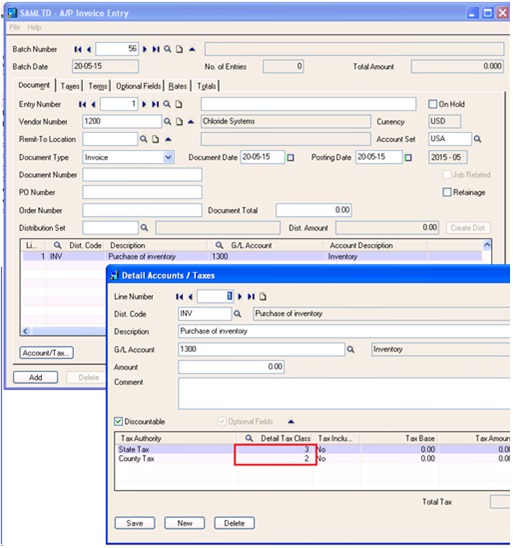

Now let’s have a look when option “Default Detail Tax Class to 1” is unchecked.

In this case it sets the tax class as 3 and 2 which were set in the A/P Vendor master screen. [Refer below screen shot].

However, this option can be changed any time as per the convenience of the user.

Thus, If you want to use 1 as the default tax class for new invoice details keep this option as checked and if you do not select this option, Accounts Payable uses the vendor tax class (from the Invoice Entry Taxes tab) as the default for new invoice details.

Also Read:

1.Allow Non Inventory Item Option in PO

2.Allow Fractional Quantities in Purchase Order

3.Allow edit of System generated batches

4.Allow Adjustments in Payment batches

5.Allow editing of external batches