In our previous blog we have discussed on the Payment Reversal transaction and the effect of it on Bank Book in SAGE 300 ERP https://www.greytrix.com/blogs/sageaccpacerp/2013/10/30/reverse-transactions-payment-reversal-transaction-in-sage-300-erp/

In this blog let’s understand the effect of Payment Reversal on Bank G/L and Vendor Balance. Scenario to understand the GL Effect is there is a Payment of 1,500 made to Coastal Heating of Ottawa – Vendor ID 1400 which is reversed using Bank Reversal screen on account of incorrect date selection.

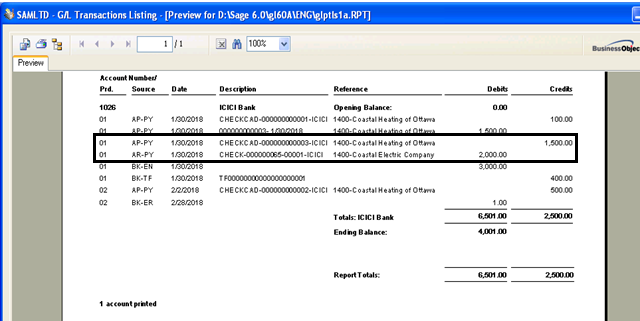

Effect of Payment Reversal on Bank GL Balance in SAGE 300 ERP:

In the screen print above, have a look at the highlighted part of the report. The report is the GL Transaction listing of the Bank Account. The 2nd entry is coming from the A/P Payment Entry of 1,500 which is on credit side where as the first is the Reversal Entry of the A/P Payment of 1,500 which is on debit side. Please note the report is sorted on description and hence the reversal effect is seen first and then the originating entry.

New Stuff: Advance Payment to a Vendor

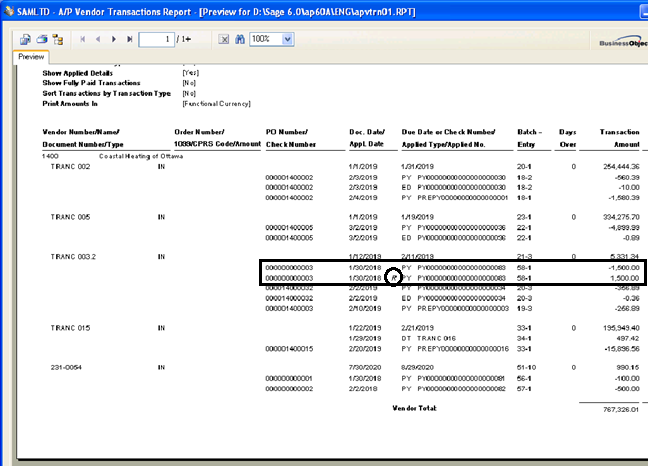

Now let’s see the Effect of Payment Reversal on Vendor Balance in SAGE 300 ERP:

In the above screen print, have a look at the highlighted transaction. We can see the selected part in the report out of which 1st is the A/P Payment Entry of 1,500 which is in negative (credit).

The 2nd is the Reverse Entry of the A/P Payment of 1,500 which is in positive (debit). One more thing you can see is before Payment No. R is added as a prefix which indicates the Reverse Transaction.

Through the reference of G/L Transaction Listing Report and A/P Vendor Transaction Report we can come on conclusion that our Bank GL and Vendor Balance are also properly affected. After posting Payment Reversal transaction, system automatically affects the accounting in SAGE 300 ERP.

Also Read:

1. Reverse Transactions – Payment Reversal Transaction in SAGE 300 ERP

2. AP Vendor Activity in Sage 300 ERP

3. Check Printing in Sage 300 ERP

4. Generate Separate Payment for each Invoice