Sage Intacct has introduced a new application Tax Deducted at Source (TDS). TDS is an essential part of the tax system that guarantees revenue collection and compliance. It is a system that deducts a predetermined percentage of taxes from payments for a variety of transactions, including interest and salary. In previous blog we have explored the setup screens utilized for configuring TDS Entries. Now let us study TDS deduction mechanism in our Sage Intacct ERP.

New Stuff:- GL Voucher in Sage Intacct

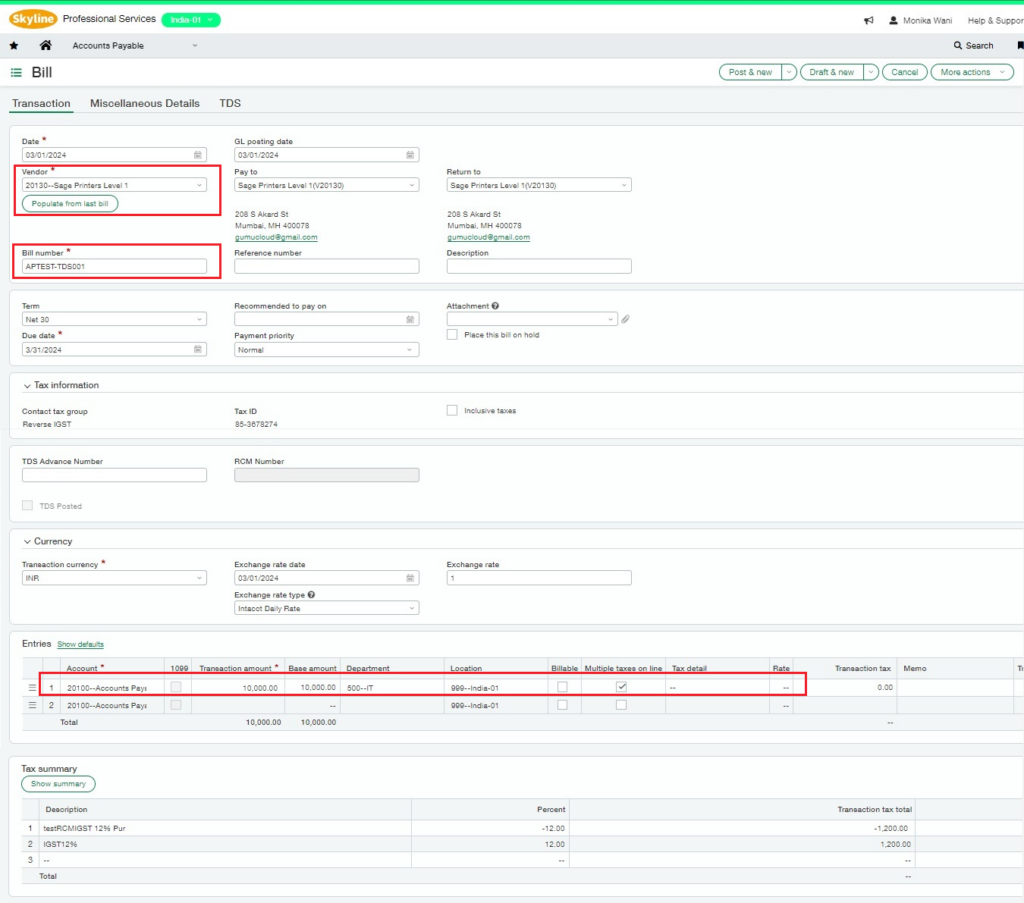

Let us navigate to Accounts Payable Bills UI

Proceed with below Steps for the deduction process

- Choose the vendor listed in the TDS Party Details from the Vendor field.

- Enter a Bill Number.

- In the Entries Section, select an Account & enter Transaction Amount for E.g., INR 10,000

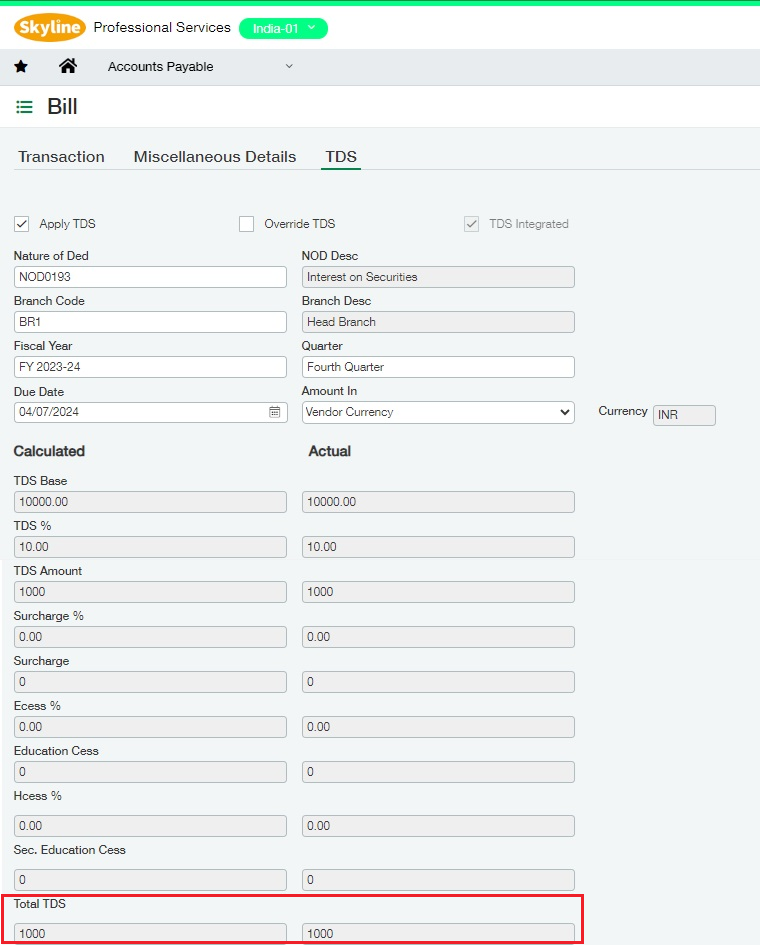

4. Go to TDS Tab.

- Apply TDS: The Apply TDS checkbox is automatically selected when the chosen vendor is an active Party Vendor. Users have the option to uncheck this box if TDS deduction is not required.

- Override TDS: The Override TDS checkbox is used when a user intends to modify the TDS amount without altering the Bill Amount.

- Nature of Deduction: The Nature of Deduction is retrieved from the Party Details screen of the chosen Vendor.

- Branch Code: The Branch Code is obtained from the Party Details screen of the selected Vendor.

- Fiscal Year: Fiscal Year is retrieved from the TDS master Options screen

- Quarter: The Quarter is presented based on the chosen Bill Date.

- Due Date: The Due Date is adjusted according to the selected Bill Date and is obtained from the TDS Fiscal Year screen.

- Amount In: A dropdown is available in this field for choosing either Vendor or Functional Currency.

Furthermore, on this page, both Calculated and Actual Sections are visible, featuring TDS fields that showcase the overall TDS amounts. These computations are retrieved based on the Nature of Deduction chosen from the NOD UI.

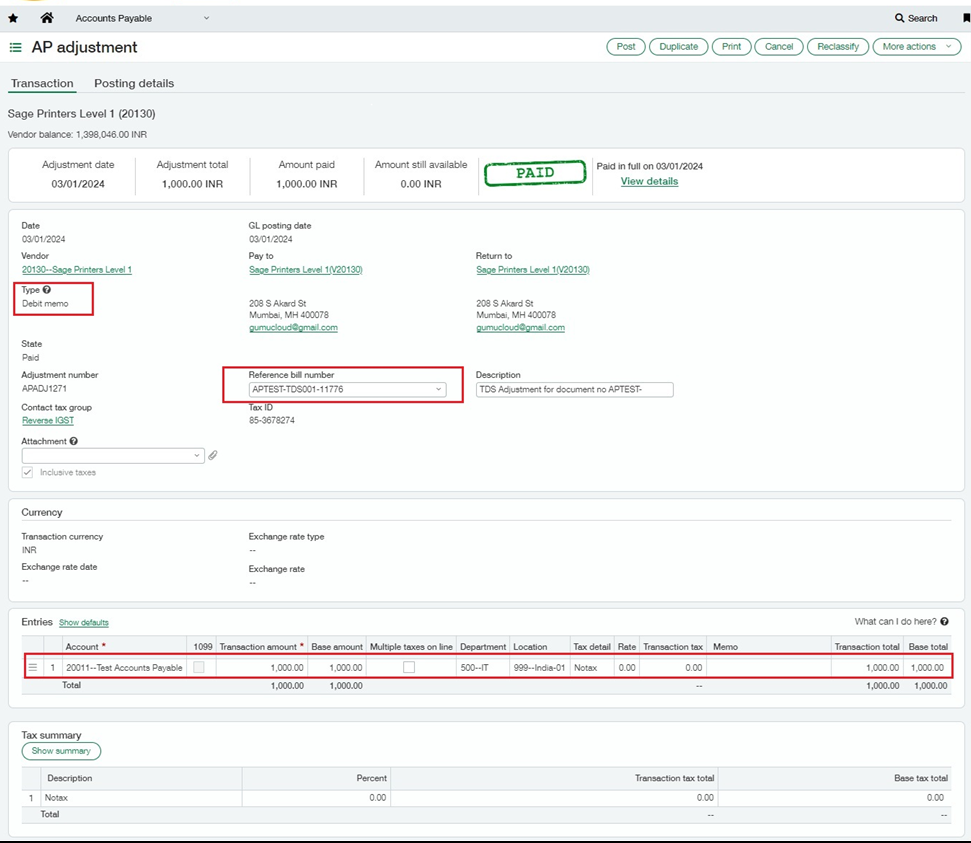

5. Click on Post Button

Upon clicking the Post button, TDS will be deducted. Users can also verify the status of the AP Bill, which is updated to “Partially Paid.”.

6. An Adjustment Entry for the deducted TDS amount will be automatically generated with the Debit Memo type. To verify the creation of the Adjustment Entry, Navigate to Accounts Payable Adjustments.

7. The AP Bill, including the deducted TDS amount, will subsequently appear on the Create Remittance Screen.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.