Applying Tax Deducted at Source (TDS) advances on invoices refers to the practice of deducting tax from a payment before it is made to the supplier or service provider, based on the applicable TDS rates. In our previous blog for Sage Intacct , we discussed the process of TDS deduction on Accounts Payable Advances. In this blog, we will focus on TDS deduction for AP Bills by applying the advance transactions.

New Stuff: Sales Journal Report in Sage Intacct

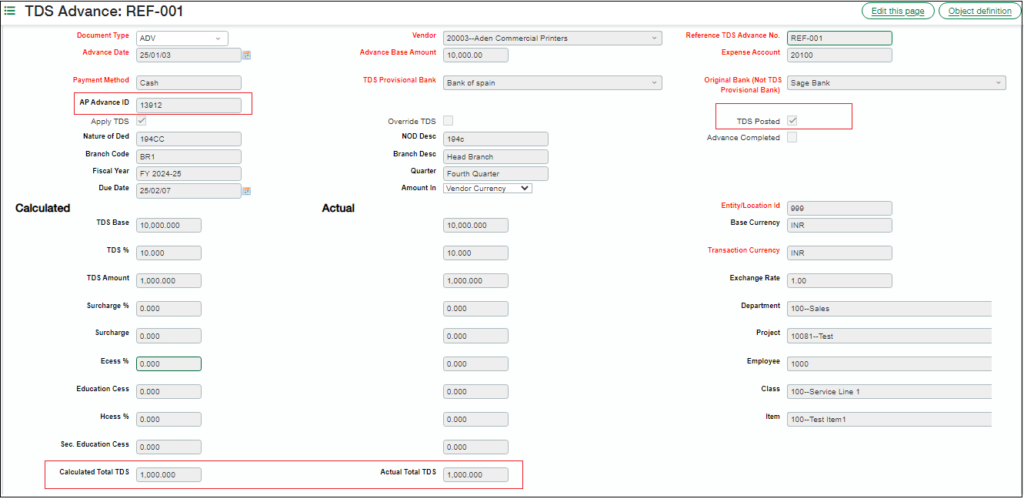

User needs to create an AP Advance transactions. Once the transaction is posted a unique Record Number is generated by the System. This Record Number auto-flows into the AP Advance ID field on TDS Advance UI

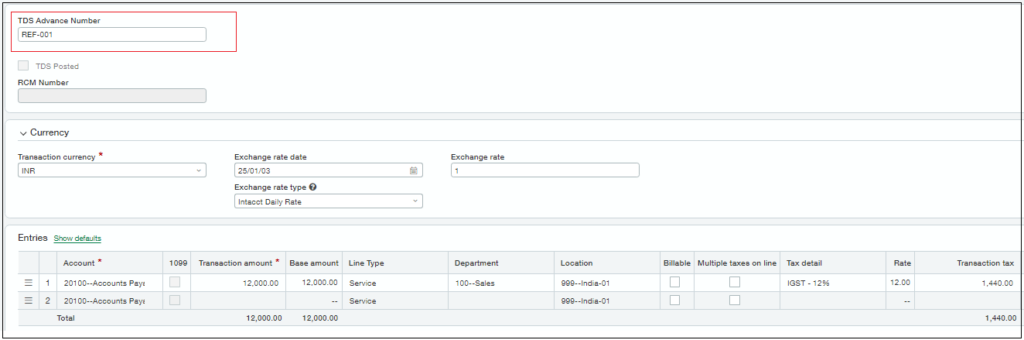

Now for applying this Advance to an AP Bill, user needs to create an AP Bill with same Vendor and select the Reference TDS Advance No. in the TDS Advance Number field.

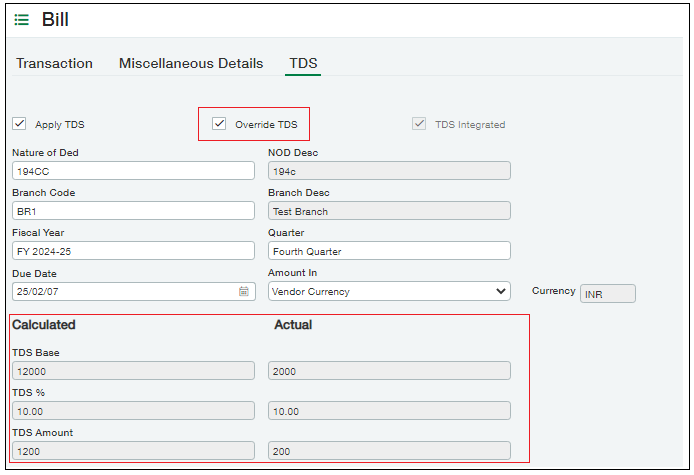

In this case when AP Advance is applied on AP Bill, Override TDS checkbox will get auto-check and Actual TDS Base amount will be calculated by the difference between AP Bill Amount and AP Advance Amount.

Thus TDS can be calculated for AP Bills by applying the Advances.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.