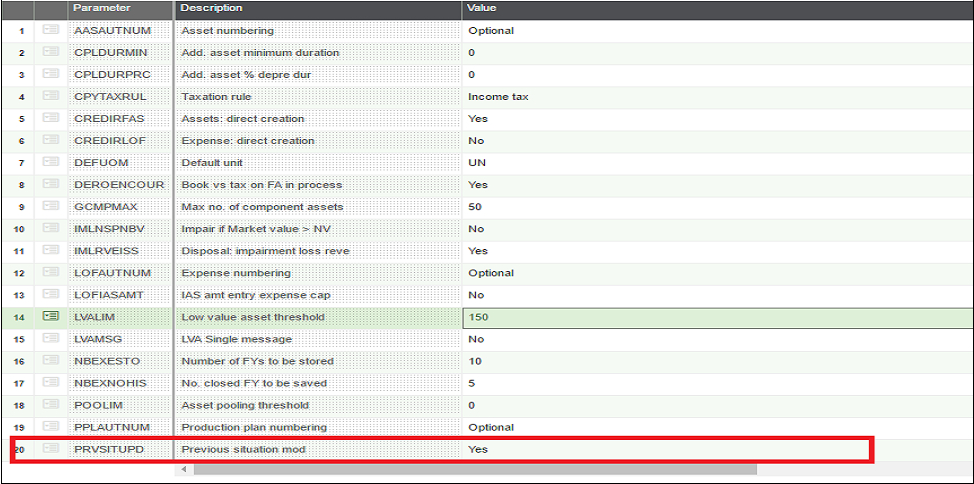

Navigate to: Setup –> Parameter Value –> AAS – FAS – PRVSITUPD

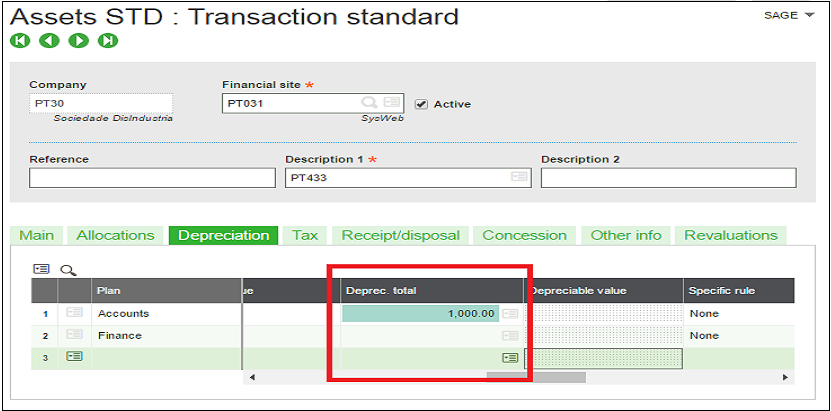

Set PRVSITUPD=”Yes “After setting this parameter to “Yes “this will allow the user to enter accumulated depreciable value under the Deprec.total (Refer below image).

If an asset was purchased in 1st Jan 2013 and it’s deprecation start date was also same.

Asset purchase value include tax 60000 and current is 1st Jan 2017.

Now in order to capture the accumulated depreciable value till 31st dec2016 which are 48000?

We can set above parameter from “No” to “Yes”.

With this way, the system will then calculate the deprecation value only on 1200 for the remaining periods.

About Us:

Greytrix is one stop solution provider for Sage ERP and Sage CRM needs. We provide complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development and implementation expertise.

Greytrix have some unique solutions of Sage X3’s integration with Sage CRM, Salesforce.com and Magento eCommerce. It also offers best-in-class Sage X3 customization and development services to Sage business partners, end users, and Sage PSG worldwide.

For more information on Sage X3 Integration and Services, please contact us at x3@greytrix.com .We will be glad to assist you.

Read more:-