We may come across the scenario where the user needs to put the specific pay by customer or the risk customer on hold. Hence processing each customer will be the crucial and time consuming task. To avoid this thing, Sage X3 has provided the feature as the customer on hold function in the below navigation:

A/P-A/R Accounting -> Open Item -> Customer Hold

This function has two different method of the processing the hold status:

Credit control

Payment delay control

Credit control:

In Sage x3, we do have the risk customer concept, where the main customer is linked to the other risk customer. The risk of paying is picked by some other customer. In this case architecture mostly lie between child and parent customer.

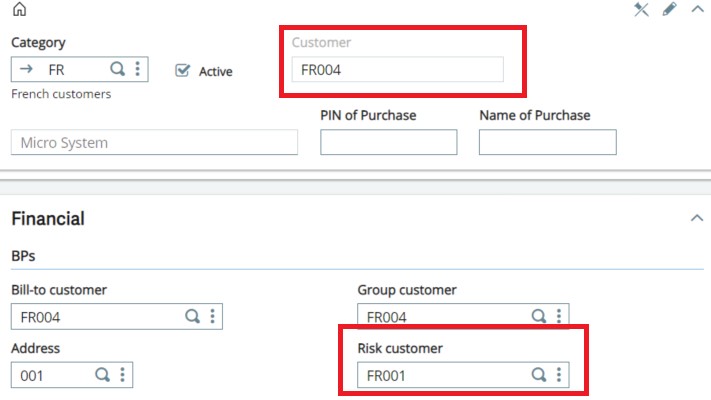

The parent customer is the risk customer and child customer is the customer which different customer in the risk customer in the Customer master as shown below.

In the above case the FR001 is the Risk customer that will acting as the parent customer and FR004 is the child customer.

Using the customer hold process we can utilize this Credit control for putting all the child customer on hold any of the child customer is held.

If any of the customer from the given range is failing the credit limit, then all the customer which hold the FR001 will placed on the hold.

Example: FR002,FR003,FR004 has the risk customer as the FR001. In this any customer FR002 or FR003 or FR004 fails the credit limit then all the customer will be placed on hold. Incase the parent customer is hold hence all the child customer are placed on the hold.

This hold status would start acting in the order by warning and would allow to make deliver but not validate or invoice.

Payment delay control

In the earlier example the risk customer needs to be considered when the customer is placed on the hold. But in this case of the Bill to customer is consider when the customer hold is consider.

As above, in this case the Bill to is consider for putting the customer on hold. In the given range of the customer if the customer contains the Bill to parent customer then all the child customer are placed on the hold.

Example: AO002, AO003 and AO004 has the bill to customer as AO001. In this scenario the AO002 or AO003 or AO004 fails to maintain the credit limit then all the customer which holds the Billto customer as AO001.

Authorize credit > ceiling:

This field will act as percentage above the credit limit should be consider to execute the hold process. We need to give this value in the form of percentage.

This features helps to skip the work of identifying the risk or the Bill to customer and then place the customer on hold.