Positive Pay is a banking service designed to mitigate check fraud risks. Customers of the bank provide a file containing account numbers, check numbers, and corresponding dollar amounts for each check. If a check is presented for payment but is not listed in this file, the bank will refrain from processing the payment and will reach out to the customer for further guidance.

In Sage X3, the positive pay file function makes a file with details about checks a company issued. This file goes to the bank. The bank checks if the checks presented for payment are valid using this file. To make a positive pay file generation in Sage X3, first, list the checks you’ve issued with details like the check number, date, and amount. Then, use Sage X3 to make a file in the format your bank needs.

This file usually has info about each check, like the check number, date, amount, and the payee’s name and account number. When a check is brought to the bank for payment, they use this file to check if it’s valid and issued by your company. Making a positive pay file generation can stop fraud by making sure only allowed checks get paid. Sage X3 has tools to help you manage issuing checks, including making positive pay files.

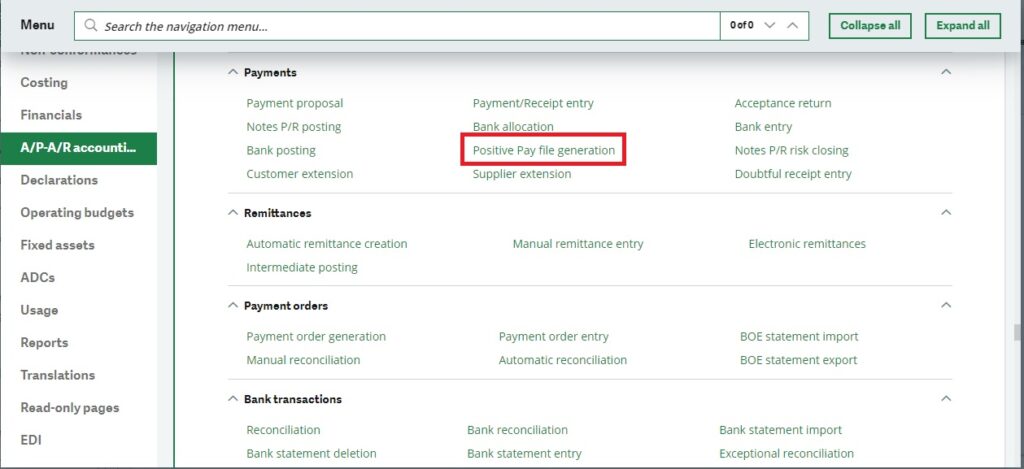

Navigate to access this function:

A/P-A/R accounting -> Payments -> Positive pay file generation

Figure 1: Navigation page

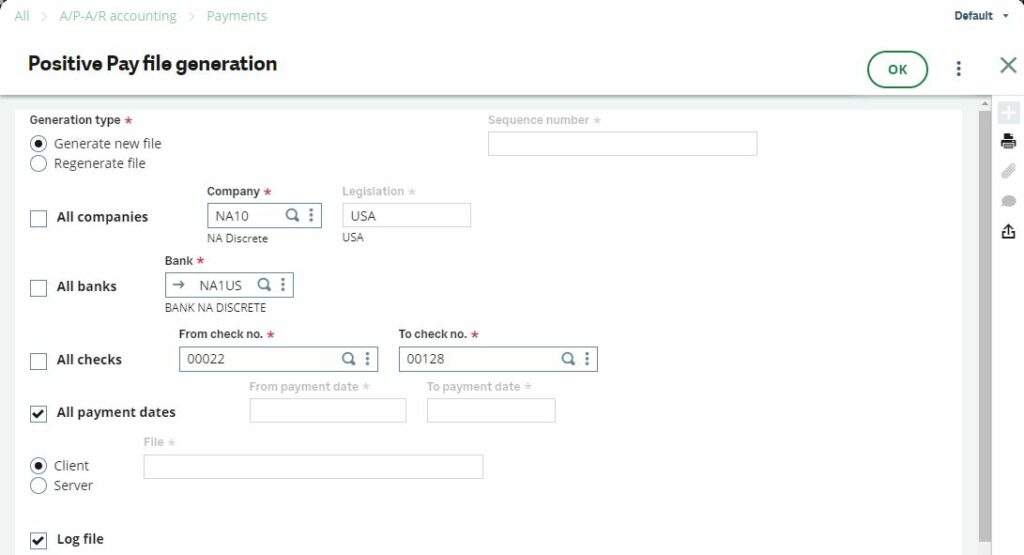

Utilize this function to create the Positive Pay bank file, which gathers data from Supplier payments (PAYMENTH) and the check table (CHQNUM) to generate an output file for previously unprocessed records. The file conforms to the specified file format of the bank and encompasses checks with statuses such as Issued, Voided, or Posted. Only records with a null Positive Pay sequence number are included, along with voided checks meeting the same criteria. If a check is voided subsequent to its inclusion in a previous file, the accounting cancellation process will reset the Positive Pay sequence number and creation date. It’s also possible to regenerate the file using the sequence number.

Select the criteria like select new Generate new file if you want to create a new file or select Regenerate file to modify the already generated positive pay file but here you need to select sequence number. Select the Bank account, From check no. And To check no. Then, click OK. Refer Figure 2.

Figure 2: Positive pay file generation selection screen.

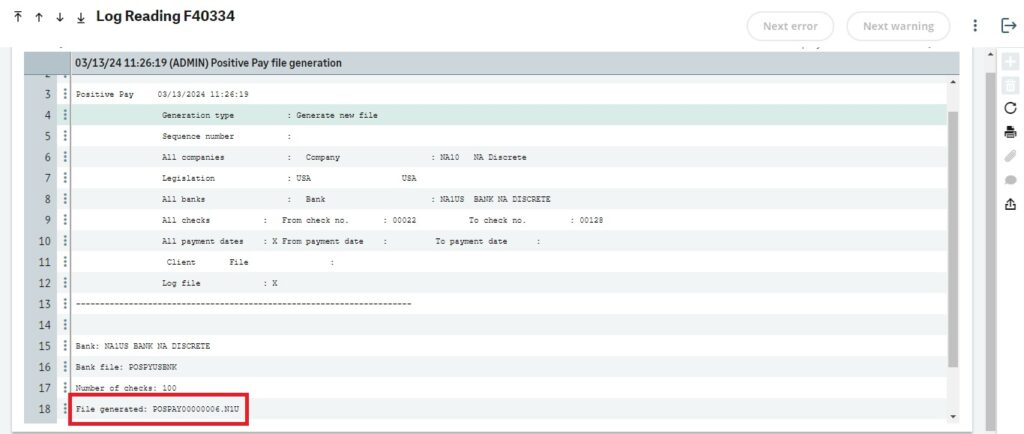

It will generate the log as well as the positive pay file as shown in figure 3.

Figure 3: Positive pay file creation log

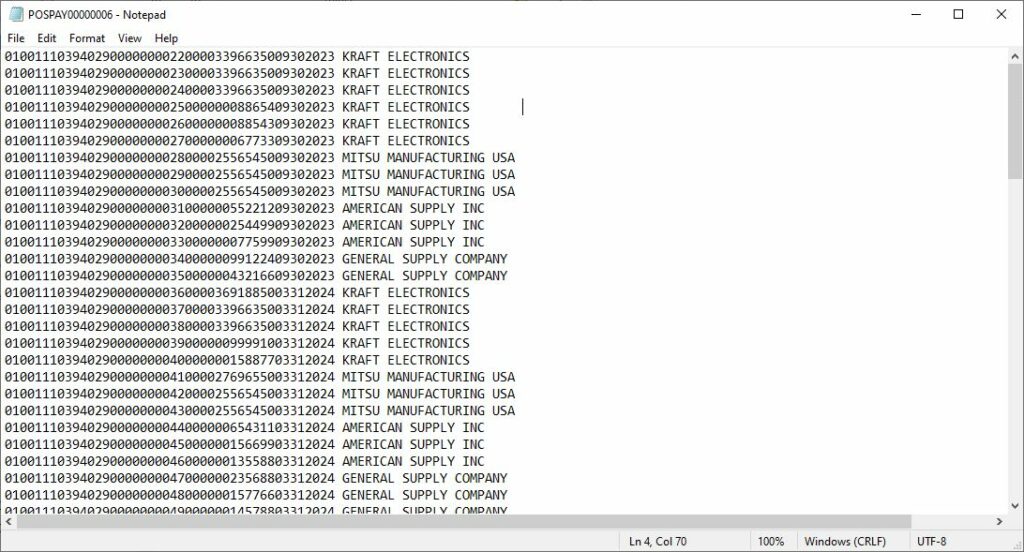

This positive pay file will look like Figure 4. Which is further submitted to the bank for verification process.

Figure 4: Exported positive pay file

You can explore the folder where the files are kept and check them out. You can also save the files to the “Download” folder in the client directory or save them to the server. By default, the server will save them in the “BQE” folder, but you can choose another location if needed.

You can check the file, but it might be hard to read, especially if you have a lot of files, which could take up a lot of time.

I generated Positive Pay for checks numbered 00022 to 00128. If you’re looking for 00128, there’s no need to go through more files.

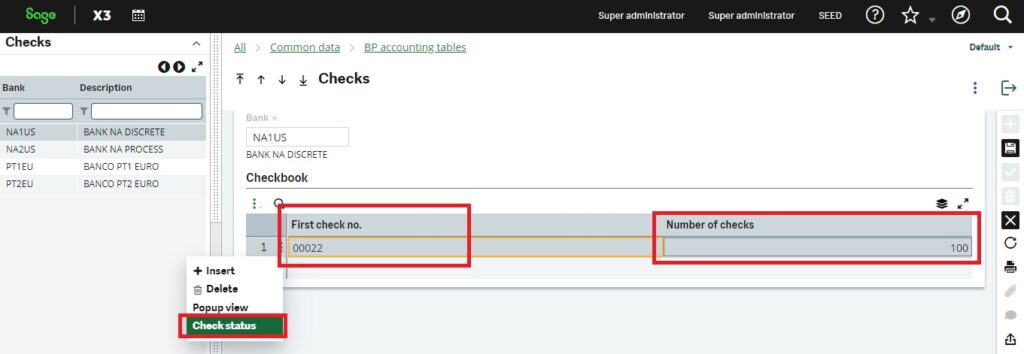

Here’s an easier way: Go to Common Data, then BP Accounting Tables, then Checks, and choose the Bank. Next, on the checkbook line starting from 00022, click the action icon, and from the dropdown menu, choose Check Status.

Figure 5: Check the status of the positive pay file

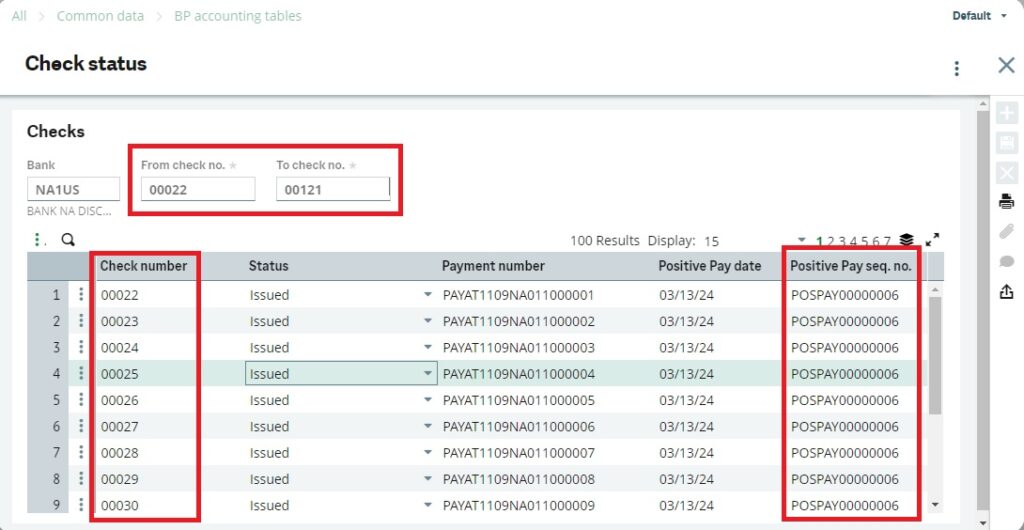

The Check status displays both the Positive Pay date and the Positive Pay sequence number. It’s important to note that if any check number has a sequence number different from the others, it indicates that it was included in a different file. This distinction helps to track and manage the Positive Pay process effectively, ensuring accurate recordkeeping and fraud prevention measures.

Figure 6: Positive pay seq. number for every check number

This blog demonstrates that the Sage X3 provides user-friendly tools and functionalities to facilitate the Positive Pay process, ensuring smoother operations.