Title – How to Configure Legal and Analytical Reporting Account Setup for multiple companies in Sage X3

Summary -This functionality in Sage X3 will enable the users to view the Account balances at reporting level in either Company’s Local currency (Legal) and in other currencies (Analytical) if there are multiple Companies in same or other countries.

Below is the scenario described along with the setup which will elaborate the different functions setup which are supposed to be configured when the Company setup is done in Sage X3.

Scenario– A Company XYZ Pvt. Ltd.as Group Company is located in Country 1 (Kenya) and in Country 2 (Rwanda) having their own respective local currency. When the reports are viewed in a Company which is in Country 1 (Kenya) it will be either in Local currency or in some other foreign currency.

Similarly when reports will be viewed in Country 2 (Rwanda) it will be either in Local currency or in the currency applicable in Country 2 (Rwanda). This is where the Legal and Analytical setup is required to be configured. The defined 2 Companies in 2 different countries will be treated as 2 separate Legal entities.

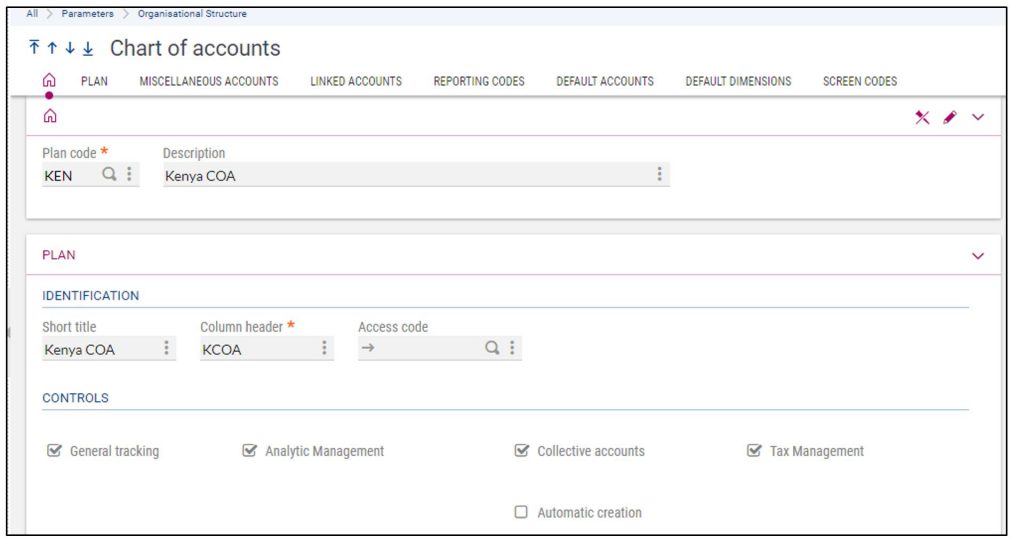

Step 1: Chart of Accounts

There will be three different Chart of Accounts will be created for a Company-

- Country 1 Analytical CoA (Kenya)

- Country 1 Legal CoA (Kenya)

- Country 2 Legal CoA (Rwanda)

Based on the system process and available provision CoA we will be defined. In CoA “General Tracking” and “Analytical Tracking” check box should be ticked in all the CoA defined.

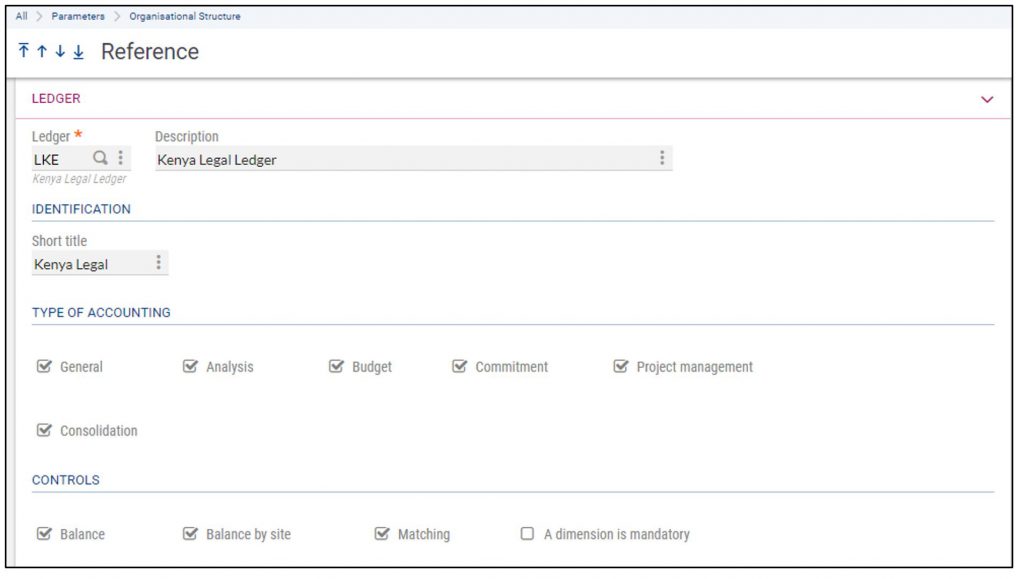

Step 2: Ledgers

A ledger is associated with the setup data of the Chart of Accounts. Ledgers also contain the management rules connected to the matching and year-end rules.

There will be three different Ledgers will be created for a Company which will be applicable to the respective legal entities, one individually for Legal and another for Analytical-

- Country 1 Analytical Ledger

- Country 1 Legal Ledger

- Country 2 Legal Ledger

Every individual Ledgers created will have its Unique Code along with the other details of Dimensions and Budgets if applicable.

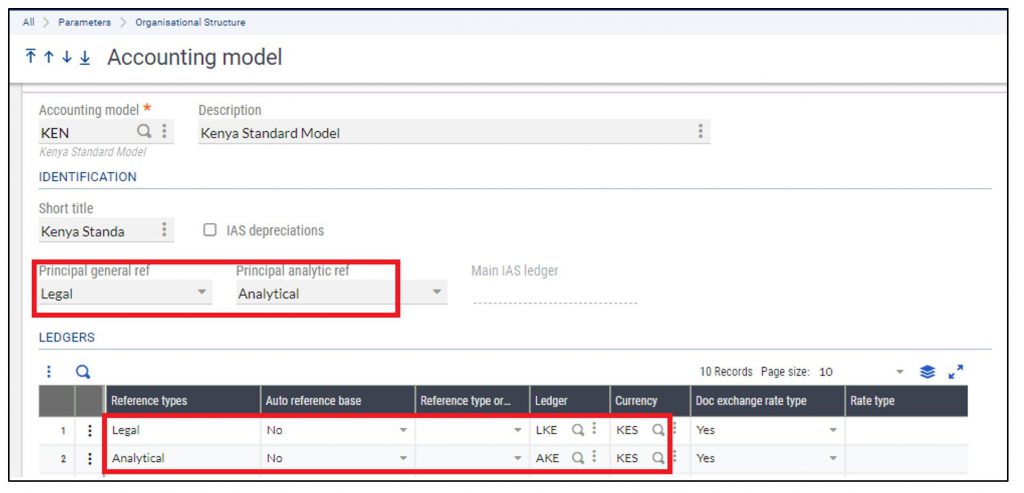

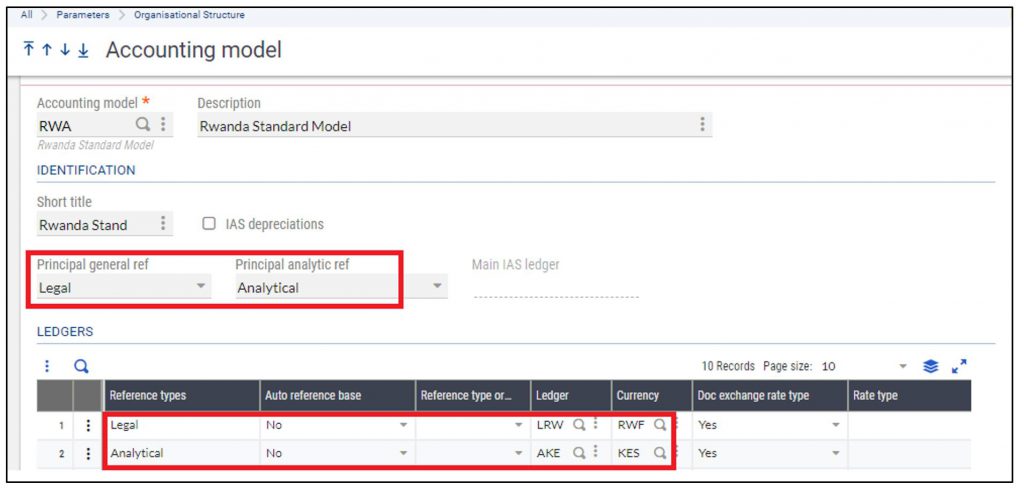

Step 3: Account Core Models

This function is a structure containing the Chart of Accounts, which is to be applied to both the legal companies. One model can be linked to a single or several legal companies within the same country or legislation. Every individual Account Core Model created will have its unique code.

The following Account Core Model will be created for both the Legal Entities-

- Country 1 Standard Model

- Country 2 Standard Model

For every Standard Model select the Proper “Principal General ref” as “Legal” and “Principal Analytical ref” as “Analytical”.

Based on that in the table for Legal and Analytical reference types map the correct Ledger code created earlier along with the desired currency for Legal and Analytical reporting. Refer Screenshot for reference for Country 1 & 2 Standard Model.

Step 4: Accounts

Different Accounts will be created in individual Chart of Accounts with their own respective Account codes.

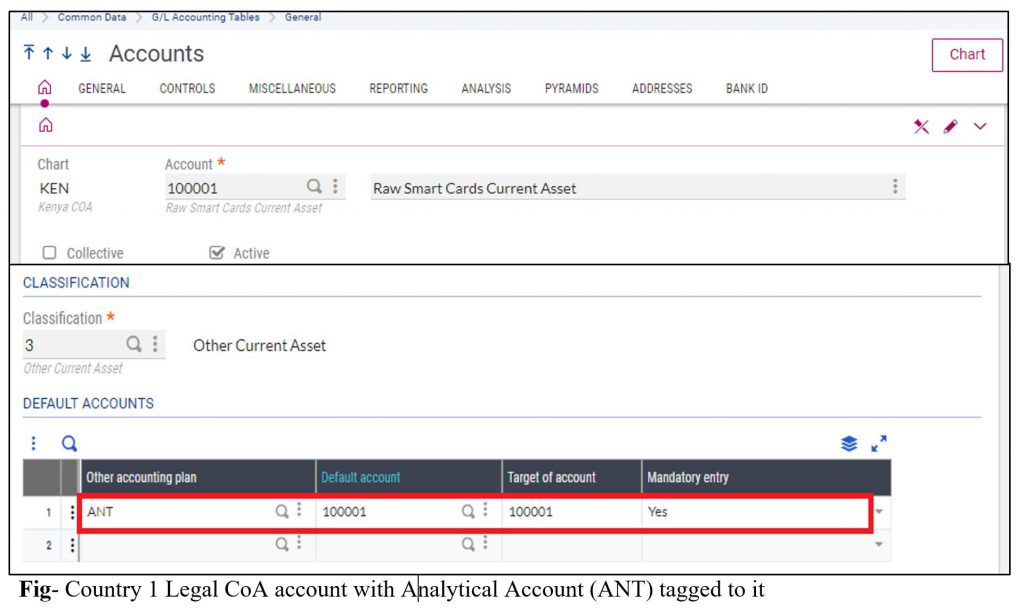

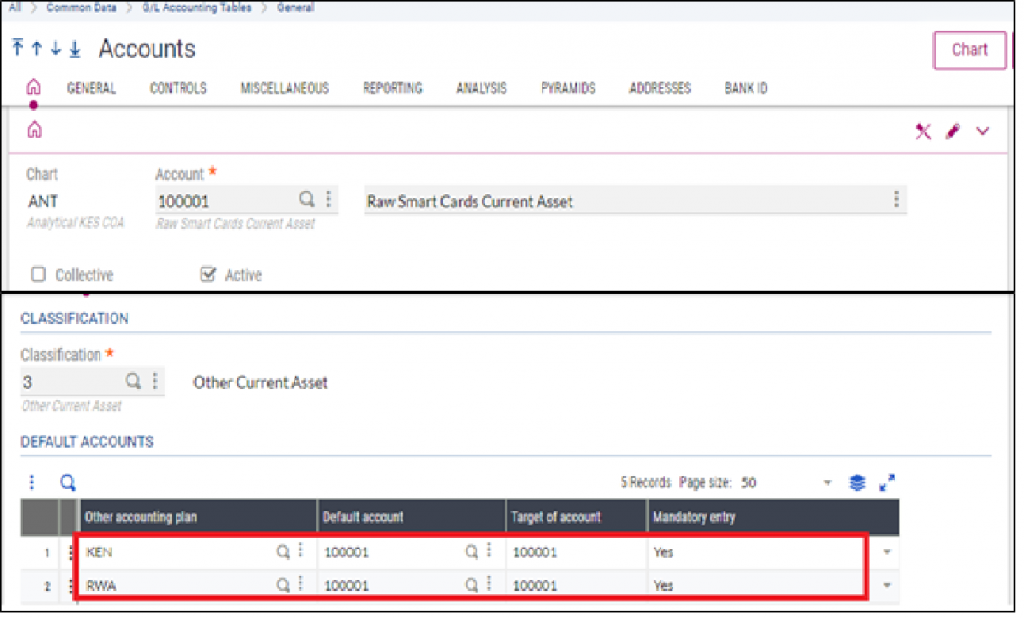

In each and every Account of Country 1 Legal CoA, the relevant Analytical Account Code will be tagged which is created in the Country 1 Analytical CoA. Similarly for the Account in Country 2 Legal CoA, its relevant Analytical Account Code will be tagged.

Refer Screenshot for reference of a particular Account in Legal and Analytical tagged to it.

Transaction

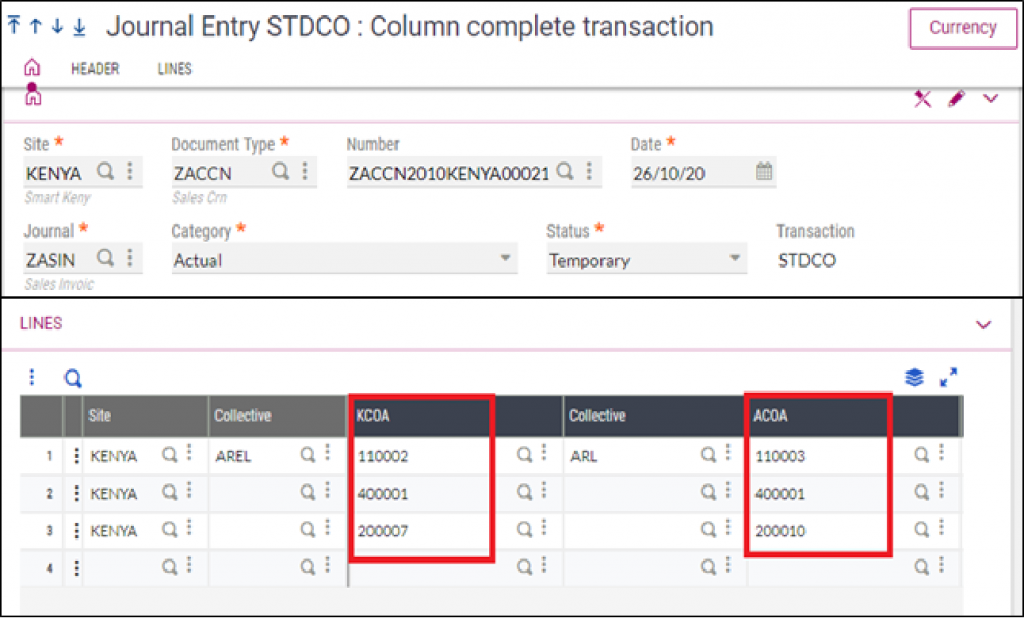

When any transaction is created is Country 1 and when it’s relevant Journal Entry gets created in the system, automatically the system shows the Country 1 Legal Account code along with the mapped Country 1 Analytical Account code. Refer screenshot for reference.

Conclusions

Thus by following the above stated steps, legal and analytical setup required for multiple companies reporting shall be configured in Sage X3.