E-invoicing for Sage ERP Software Integration

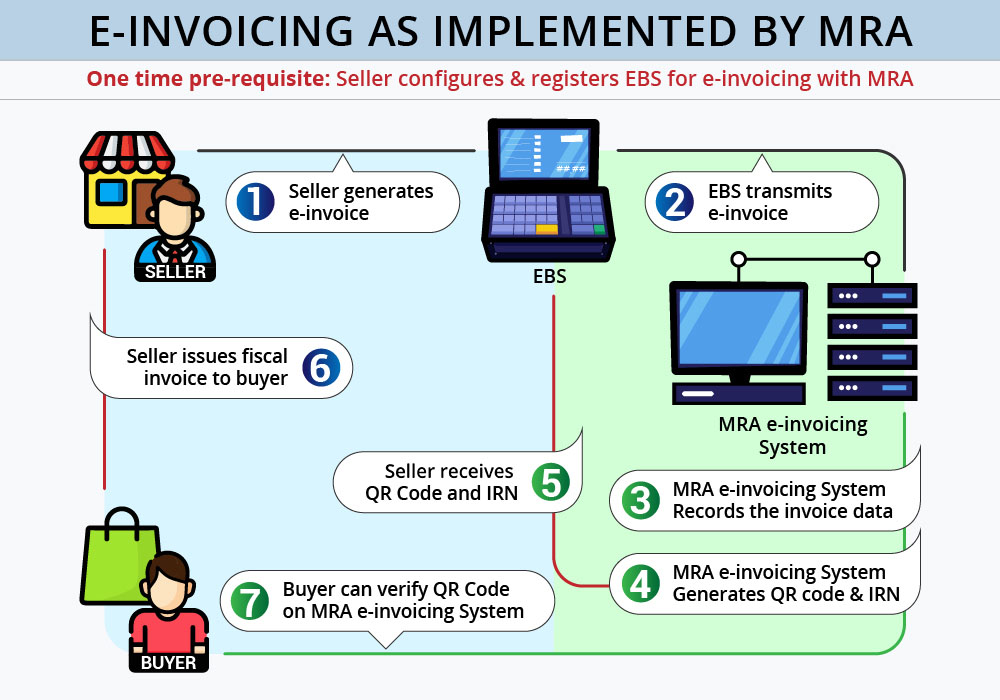

The Mauritius Revenue Authority (MRA) has implemented e-invoicing to improve VAT compliance and streamline invoicing. This initiative aligns with recent amendments to the Value Added Tax Act (VAT Act), requiring e-invoicing to enhance transparency and efficiency. Businesses must now adopt this digital approach to invoicing, ensuring all transactions are accurately recorded and reported. The MRA’s move towards e-invoicing also aims to reduce tax evasion and support the digital economy.

Characteristics of Electronic Tax Invoice Management System

Buyer PIN (optional)

It refers to the purchaser's Personal Identification Number (PIN). Capturing this information is necessary only when the buyer intends to claim input tax for the VAT paid. In such cases, the buyer should provide their PIN details.

Control Unit serial number

The Mauritius Revenue Authority (MRA) issues this unique number to identify the Electronic Tax Register (ETR).

Control Unit invoice number

This unique number is generated by the ETR for each tax invoice issued.

Quick Response (QR) code

This code is included on the tax invoice to confirm validity.

Benefits of E-invoicing with Sage ERP (Sage X3 | Sage 300)

Ease of Tax filing

Data Security

Bi-Directional Data Integration

Automated Notification Alert

Avoid Tax Evasion

Enhanced QR code capabilities

Improvement in Account Reconciliation

Streamlined Audit Trail

Fast and Safe MRA e-Invoicing Solution

We are introducing Greytrix Middle East’s Fast and Secure MRA e-Invoicing Solution! Our quick and seamless e-invoicing software effortlessly generates e-invoices. Get ready for e-invoicing in just a few days and experience the fastest invoice generation.

Guarantee 100% Accuracy in e-Invoice Generation

Our e-invoicing solution features multiple auto-validation checks to ensure complete accuracy and compliance with Mauritius Revenue Authority (MRA) requirements. Designed for Mauritius, it promotes data precision and effortless e-invoice generation in accordance with MRA standards.

Embrace Digitalization

The Mauritius Revenue Authority (MRA) has implemented the e-invoicing mandate to digitalize and improve VAT compliance in Mauritius. This initiative aligns with the recent amendment to the Value Added Tax Act (VAT Act) regarding the e-invoicing system. Greytrix Africa's e-invoicing software guarantees full compliance with MRA regulations and offers seamless integration with Electronic Billing Systems (EBS) for a smooth invoicing experience.

What Makes Greytrix Middle East’s E-invoicing Solution Better

Seamless Integration

The e invoicing system for Mauritius ensures smooth integration with electronic billing systems, enhancing efficiency and ease of use.

Advanced Invoicing Solution

Our cutting-edge e-invoicing solution streamlines processes and maintains data integrity with robust duplicate invoice protection, preventing redundancies and billing errors.

Custom E-invoice Solution

Tailor your e-invoicing templates to meet your specific requirements using our versatile e-invoicing software.

Auto Data Validation

Our e-invoicing solution automatically validates invoice data, guaranteeing complete accuracy in e-invoice generation.

Our Partnerships