URA Introduces EFRIS for Seamless Electronic Invoicing

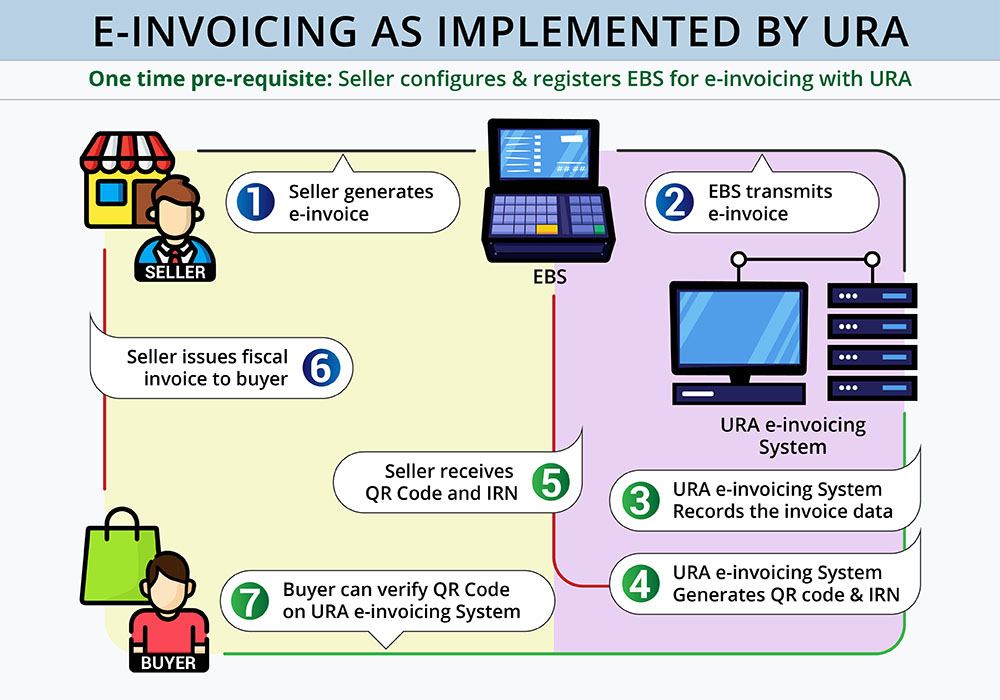

How E invoicing Works in Uganda Revenue Authority (URA)

E-invoicing

By logging into the customer application on the URA web portal, users can securely issue electronic tax documents at no cost. The validity of these records can be verified using the URA verification app or a QR reader.

Electronic financial instruments (EFDs)

This system, comprising a networked point-of-sale (POS) system and a virtual Sales Data Controller (SDC), enables the creation of electronic receipts and invoices. It includes a secure component that transmits financial information to the EFRIS system. Additionally, it facilitates the retrieval of financial data and the generation of transaction reports.

Electronic dispenser controls (EDCs)

This component is designed to manage fuel and petrol stations. Special devices monitor and calculate the capacity of fuel pumps in real time, ensuring efficient operations. This information is transmitted to the EFDs to generate electronic receipts.

Benefits of E-invoicing with Sage ERP (Sage X3 | Sage 300)

Ease of Tax filing

Data Security

Bi-Directional Data Integration

Automated Notification Alert

Avoid Tax Evasion

Enhanced QR code capabilities

Improvement in Account Reconciliation

Streamlined Audit Trail

What Makes Greytrix Middle East’s E-invoicing Solution Better

Integration Expertise

We Specialize in seamlessly integrating E-invoicing with ERP systems for real-time data transfer to URA's EFRIS, reducing errors and enhancing efficiency.

Customization

Highly customizable to meet specific business and URA requirements, handling unique invoicing formats, tax regulations, and reporting standards.

Comprehensive Support

We offer full-service support, including implementation, training, and maintenance to ensure smooth E-invoicing compliance.

Regulatory Adherence

Maintains up-to-date compliance with URA regulations, ensuring legal and technical requirements are met without disruption.

Operational Efficiency

Automates invoicing processes, integrates with Sage X3 ERP system, and improves processing times and accuracy for streamlined financial reporting.

The URA provides several options for taxpayers to generate electronic receipts and invoices:

System-to-System Connections

Customers with existing sales systems can integrate their Enterprise Resource Planning (ERP) with EFRIS for real-time transmission of transaction details.URA Web Portal

The web portal allows users to generate electronic invoices and receipts using a TIN and password.Client Application

Taxpayers can install software to create electronic receipts and invoices on their devices.Electronic Financial Devices (EFDs)

EFDs can easily create electronic receipts.USSD Fast Codes

Using Unstructured Supplementary Service Data (USSD) codes, taxpayers can generate electronic receipts via mobile phones.

Our Partnerships